Demystifying Credit Cards: A Guide to Maximizing Value and Miles

Navigating the world of credit cards can feel overwhelming with the sheer number of options and the intricate clauses tied to them. It’s easy to get lost in the quest to find the best card for your spending habits. In this blog, I aim to demystify some of the key concepts surrounding credit cards, focusing on how to make the most of your spending and earn the best rewards, specifically through miles.

Before diving into the specifics, let me start by laying out a few foundational points about my approach to credit cards:

1. Team Miles

I am firmly on “Team Miles.” For me, almost all my credit card spending revolves around accumulating miles that can be redeemed for travel. This means I prioritize cards that offer great mileage rewards for every dollar spent.

2. Consolidation Over Diversification

Rather than spreading my spending across cards from multiple banks, I prefer to consolidate my cards under one bank (as much as possible). This strategy simplifies monitoring my spending and reduces complications related to transferring points. Many banks impose high administrative fees when converting credit card points to airline miles or travel programs—typically S$27.50 per transfer. By consolidating my cards, I can benefit from credit cards that allow pooling of miles, enabling me to pay the transfer fee only once. This approach not only minimizes fees but also makes it easier to manage my rewards efficiently.

3. The 4-Miles Rule

A key criterion I use when selecting credit cards is the 4 Miles Per Dollar Rule (4MPD). With so many cards now offering at least 4mpd, I exclude any card that earns below this threshold. This ensures I maximize the value of my spending and make the most out of every transaction.

4. Simplification and Disclaimer

While I’ve outlined some of the key rules and approaches I use, it’s important to note:

- Not Financial Advice: This blog reflects my personal experience and preferences and is not meant as financial advice.

- Simplified Explanations: I won’t be diving into all the technicalities, exclusions, and terms for every card, as that would make this post overly long and complex. If you’re interested in the full details, I encourage you to review each card’s terms and conditions directly.

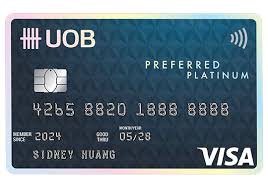

My First and Favorite Credit Card: UOB Visa Preferred Platinum Card

The first credit card I want to highlight is the UOB Visa Preferred Platinum Card, which also happens to be my favorite. While this card isn’t officially classified as a “miles card,” it indirectly helps you accumulate miles through UNI$. Let me break it down.

How It Works

Instead of earning miles directly, this card rewards you with UNI$. Each UNI$ can be converted to 2 miles. Here’s how the card works:

- Contactless Payments: You earn 10 UNI$ per S$5 spent on eligible contactless payments or selected online transactions. This is equivalent to 4 mpd

- Spending Beyond S$1,110: Once you exceed the monthly cap of S$1,110, your rewards drop significantly. You earn only 0.2 UNI$ per S$1 (equivalent to 0.4 mile per S$1), which is far less attractive.

Why I Like It

One of the key reasons I love this card is its flexibility. Unlike cards that restrict rewards to specific spending categories (e.g., dining or travel), the UOB Visa Preferred Platinum Card is versatile and can be used for a wide range of purchases. This makes it ideal for general spending, especially since most of my transactions in Singapore—whether buying drinks, shopping, or dining out—are easily made through PayWave.

However, it’s important to note that to earn the 4 mpd, payments must be made via mobile contactless methods such as Google Pay, Samsung Pay, or Apple Pay. Using the physical card for PayWave transactions will not qualify for the 4 mpd reward rate.

Additionally, the card also allows for online spending, though only in certain categories (see below). Still, it remains my go-to card for day-to-day purchases, as I don’t have to overthink which category my spending falls into.

| Category | Merchant Category Codes (MCC) |

| Department Stores and Retail Stores | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5661, 5691, 5699, 5732-5735, 5912, 5942, 5944-5949, 5964, 5966-5970, 5992, 5999 |

| Supermarkets, Dining and Food Delivery | 5811,5812,5814, 5333, 5411, 5441, 5462, 5499, 8012, 9751 |

| Entertainment and Ticketing | 7278, 7832, 7841, 7922, 7991, 7996, 7998-7999 |

Key Downsides

However, like all cards, this one isn’t without its limitations:

- Monthly Cap: The rewards are capped at S$1,110 of spending per month. This means that once you hit this amount, further spending will no longer earn the optimal UniDollar rewards.

- Spending Blocks of S$5: Another limitation is that rewards are only earned in blocks of S$5. For example, if you buy a coffee for S$3 or a Snickers bar at a petrol station, the transaction won’t qualify for UNI$ rewards.

- PayWave or Specific Transactions Only: To use this card effectively, you’ll need to enable Apple Pay or Google Pay, as it’s not as straightforward as simply using the physical card for contactless payments. The card earns miles only for PayWave transactions or certain online transactions under MCC categories.

My Tips for Using This Card

Because of these restrictions, I recommend linking this card to your iPhone or Android phone and keeping the physical card at home. It’s ideal for everyday PayWave transactions, such as shopping or dining, where you’re likely to meet the spending criteria. However, for small purchases under S$5, it’s better to use another card to avoid losing out on rewards.

The UOB Visa Signature Card

The second credit card I want to highlight is the UOB Visa Signature Card. While it offers excellent mileage rewards, it comes with more conditions and nuances compared to the UOB Visa Preferred Platinum Card. Here’s an overview:

How It Works

This card allows you to rake up to 4 mpd on spending, but it requires you to meet certain criteria:

- Minimum Spending: You must spend a minimum of S$1,000 per statement month to qualify for the 4mpd. Spending less than S$1,000 in total for the statement month results in significantly lower rewards—only 0.2 UNI$ per S$1 spent (equivalent to 0.4 mpd).

- Cap on Spending: The rewards are capped at S$2,000 of spending per statement month, with spending divided into two separate categories: local PayWave transactions and overseas spending. To earn 4 mpd in each category, you must fulfill the minimum spend of S$1,000 for that category.

For example, if you spend S$1,300 in total—S$1,000 on local PayWave transactions and S$300 on overseas spending—you will only earn 4 mpd on the S$1,000 spent locally via PayWave. The S$300 spent overseas will not meet the minimum threshold for that category and will not qualify for 4 mpd. - Miles Calculation: The maximum miles you can earn with this card is 8,000 miles per statement month, based on the S$2,000 spending cap (S$2,000 x 4 mpd). Spending is consolidated across the entire statement month and calculated in blocks of S$5. For instance, if you spend S$1,302 in total, only S$1,300 will qualify for rewards, with the excess S$2 excluded.

Why I Like It

This card is ideal for higher-value spending. If I foresee a month where my spending will exceed S$1,000 on PayWave transactions, I prioritize using this card. For example, for larger purchases or significant PayWave transactions, I use the UOB Visa Signature Card to ensure I hit the S$1,000 minimum and optimize my rewards.

Additionally, I’ve taken steps to simplify managing statement and calendar months. By calling UOB, I’ve aligned all my credit cards to use a statement month that matches the calendar month. This helps me avoid confusion and track my spending more effectively.

Key Downsides

- Minimum Spending Requirement: The card’s main drawback is the S$1,000 minimum spending requirement per statement month to earn 4 mpd. Falling short of this amount drastically reduces your rewards.

- Capped Spending: Spending beyond S$2,000 per statement month does not earn additional rewards at the 4-mile rate.

- Blocks of S$5: While this card doesn’t calculate miles based on individual S$5 transactions, it consolidates your total statement month spending into blocks of S$5. Any excess that doesn’t fit into these blocks won’t earn miles.

My Strategy for This Card

I use the UOB Visa Signature Card strategically:

- When I know I’ll spend over S$1,000 in a statement month on PayWave transactions or overseas purchases.

- For big-ticket items, I plan in advance to hit the S$1,000 threshold early in the month.

While the spending requirements are higher, the card is generally more generous than others in terms of mileage rewards, making it a solid choice for planned spending.

The UOB Lady’s Solitaire Card

The third credit card I want to highlight is the UOB Lady’s Solitaire Card. Don’t let the name fool you—this card isn’t exclusively for women anymore. Since June last year, UOB opened the doors to men, because apparently, men deserve a little luxury too! So, gentlemen, if you’ve ever dreamed of treating yourself to a “Lady’s” card, now you can do it guilt-free (and earn miles while you’re at it).

How It Works

This card doesn’t have a minimum spending requirement but is capped at S$2,000 of eligible spending per statement month to earn maximum rewards. What makes the UOB Lady’s Card stand out is its customizable reward categories. Cardholders can select up to seven categories where they earn 4 mpd per S$1 spent (equivalent to 2 UNI$ per dollar). The seven categories to choose from are:

- Beauty and Wellness

- Fashion

- Dining

- Family

- Travel

- Transport

- Entertainment

Additionally, by depositing S$10,000 into a UOB Lady’s Savings Account, you can boost your rewards to earn up to 6 mpd for eligible categories. The additional 2 miles are awarded based on the date you open the UOB Lady’s Savings Account. While the technical details of this arrangement may seem complex, the key takeaway is that depositing S$10,000 unlocks a higher earning potential for this card.

My Spending Categories

For me, the two categories I prioritize are:

- Dining: Dining is one of my most frequent spending categories, whether it’s eating out at cafes or grabbing a Starbucks coffee. With this card, I can effortlessly earn 6 mpd on these purchases.

- Travel: I also choose travel as a category for big-ticket spending, such as booking hotels or flights for overseas trips. This allows me to maximize the miles I earn for significant purchases.

Other categories are available as well, and each cardholder can tailor their selection based on their unique spending habits.

Why I Like It

The flexibility of the UOB Lady’s Card is what makes it one of my favorites. Being able to select spending categories means I can focus on the areas where I spend the most, ensuring I maximize my rewards. Additionally:

- No Minimum Spending Requirement: Unlike some other cards, there’s no need to hit a specific spending threshold to enjoy the full 4 or 6 mpd.

- Generous Earning Rate: With the boosted earning rate of 6 mpd, I find it incredibly rewarding for both everyday expenses (like dining) and big-ticket items (like travel).

- Simplified Miles Calculation: Similar to the UOB Visa Signature Card, this card consolidates total spending across the statement month and calculates rewards in blocks of S$5. This is more convenient than earning miles based on each individual transaction.

Key Downsides

- Capped Spending: The maximum spending cap of S$2,000 per statement month limits the miles you can earn.

- Dependent on Savings Account: To unlock the 6 mpd rate, you need to deposit S$10,000 into the UOB Lady’s Savings Account. This may not appeal to everyone.

- Statement Month vs. Calendar Month: Like other UOB cards, this one operates on a statement month basis. I’ve aligned mine with the calendar month by contacting UOB, which helps me track spending more efficiently.

My Strategy for This Card

Whenever I spend on dining or travel, I make it a point to use this card to earn maximum rewards. For instance:

- Dining: This is a frequent, recurring expense that allows me to earn miles consistently.

- Travel: I reserve this card for big-ticket travel-related purchases like hotels or flights, ensuring I get the full benefit of 6 mpd.

When traveling or spending with family and friends, this card is my go-to for earning extra rewards. While the flexibility to choose categories is great, it’s important to tailor them to your specific spending habits to make the most out of the card.

Citi Rewards Card Paired with the Amaze Card

The fourth credit card in my lineup is slightly more complicated but highly effective when used correctly. It involves pairing the Citi Rewards Card with the Amaze Card to maximize mileage rewards. While I can’t cover every technicality, I’ll simplify the process and key points as much as possible.

The Amaze Card acts as an intermediary card that you can link to multiple credit cards. When you use the Amaze Card, it processes transactions and passes them to your linked credit card while reclassifying the transaction as an online spend.

By pairing the Citi Rewards Card with the Amaze Card, you can effectively earn 4 mpd on transactions that wouldn’t normally qualify as online spending. Here’s how it works:

- The Citi Rewards Card awards 10 Citi ThankYou Points per S$1 spent on eligible transactions.

- When you convert these points to airline miles, the conversion ratio is 2.5 points = 1 mile.

- This means for every S$1 spent, you earn 10 points, which translates to 4 miles.

In short, the pairing looks like this:

This partnership between the Amaze Card and Citi Rewards Card creates a seamless way to maximize rewards on a wide range of spending categories. However, be mindful of the limitations on travel-related spending, as some categories are excluded.

Key Benefits

- All Spend Becomes Online Spend

By using the Amaze Card, almost every purchase is classified as online spending, allowing you to maximize the Citi Rewards Card’s 4 mpd. - Rounded to the Nearest Dollar

Unlike cards that calculate rewards in blocks of S$5, the Citi Rewards Card calculates rewards based on the nearest dollar. For example: If you spend S$981.60, you’ll earn points on S$980, equivalent to 3,920 miles (980 x 4 miles).

Key Limitations

- Travel Category Exclusions

While the Amaze Card reclassifies transactions as online spending, travel-related categories such as hotels and flights are excluded from earning miles. For instance: If you book a hotel stay using the Amaze Card, it will pass the transaction to the Citi Rewards Card as an online hotel booking, but travel-related expenses are excluded by the Citi Rewards Card’s terms. - Monthly Spending Cap

The Citi Rewards Card is capped at S$1,000 of spending per statement month for earning 4 mpd. Any spending beyond this amount won’t earn additional rewards. - Statement Month Misalignment

While I’ve requested to align my Citi Rewards Card statement month with the calendar month, the best Citi could offer was to start my statement on the 28th of every month. This slight misalignment requires careful tracking of spending.

My Strategy for This Card Pairing

- General Spending:

I use this setup for everyday spending, excluding travel-related purchases like hotels or flights. This is especially effective for smaller transactions, as rewards are calculated per dollar rather than in S$5 blocks. - Amaze Card Setup:

The Amaze Card allows me to pair up to five credit cards, which can be managed and swapped easily using the Amaze app (also called the Instarem app). This flexibility lets me adjust which card is linked based on my spending strategy for the month.

Why I Like It

The pairing of the Citi Rewards Card and Amaze Card is a clever way to earn 4 mpd on a broad range of transactions. While the exclusion of travel-related spending is a limitation, this setup works well for most other spending categories, especially given the convenience of rounded-to-the-nearest-dollar calculations.

Conclusion

Choosing the right credit card depends entirely on your lifestyle and spending habits. While I’ve shared the four cards I frequently use, they might not suit everyone, especially if travel isn’t a priority. Cashback cards, for instance, could be a better fit for those focused on savings rather than earning travel rewards.

That said, cashback cards often come with requirements like tracking spending across categories or meeting minimum thresholds, which can make them harder to optimize. Personally, I prefer hassle-free options like miles cards that consistently earn 4 mpd without too much effort.

The cards I’ve highlighted reflect my personal strategy over the past two years and what I intend to use moving forward. Of course, as my lifestyle evolves, my choice of cards may change as well.

Thanks. I’m new to the miles game and still learning. In order to optimise, it seems you need more than one card, so I am thinking of what should be my second card. For me, the preferred plat seems too close to to the visa sig. Was thinking of the Krisflyer UOB instead for direct credit of miles without conversion fee as a 2nd card.

May I know if you have any difficulty getting annual fee waiver for your cards? For example, what’s the card with the lowest spending you have, and despite the low spending, did you manage to get fee waiver?

Hi, sorry for the late reply!

Yes, for KrisFlyer UOB, you could save on conversion fees. However, KrisFlyer UOB doesn’t give 4mpd, which is my minimum criterion for using a miles card.

Getting a fee waiver isn’t too difficult, especially for UOB or Citibank cards. I can’t speak for other companies though. Many years ago, I used to spend less than $1,000 per month on some cards—averaging around $500 to $600 monthly—and I was still able to get a fee waiver.

Now that my spending has increased, I still believe getting a waiver should still be achievable, even for low spenders.

Hope this helps! Let me know if you need more clarification.

Navigating credit card options can indeed be overwhelming, but your focus on miles is a smart strategy for travel enthusiasts. Consolidating cards under one bank to minimize fees and simplify management makes a lot of sense—I’ve always wondered if this approach works for everyone or just those with specific spending habits. Your emphasis on higher-value spending with this card is interesting, but what about smaller, everyday purchases? Do you think this card still offers value for those, or is it better to have a secondary card for such expenses? I’m curious, have you ever encountered a situation where pooling miles didn’t work out as planned? Your insights are helpful, but I’d love to hear more about how you handle unexpected changes in spending patterns. What’s your take on balancing rewards with flexibility?

Navigating the world of credit cards indeed feels like a maze at times, especially with all the options and fine print involved. I found your emphasis on mileage rewards particularly interesting—I’ve always wondered if sticking to one bank for all cards is really the most efficient strategy. I used to spread my spending across multiple cards, thinking it maximizes rewards, but your approach makes me reconsider. Do you think this consolidation strategy works equally well for someone with less predictable spending habits? Also, how do you handle situations where other banks offer better rewards for specific categories? I’m curious to know if you’ve ever had to make exceptions to your “one bank” rule. Lastly, have you encountered any challenges with pooling miles, or has it been smooth sailing so far? I’m tempted to try this approach but would love to hear more about your experience before committing.

This is such an insightful breakdown of credit card strategies, especially for someone like me who’s just starting to explore the world of miles and rewards. I love how you emphasize consolidating cards under one bank—it’s a game-changer for simplifying things and avoiding those pesky transfer fees. Your focus on “Team Miles” is inspiring, and it makes me wonder if I should shift my spending habits to prioritize travel rewards too. Do you think this approach works equally well for someone who doesn’t travel as frequently? Also, how do you handle situations where a card’s limitations, like category-specific spending, might hinder your rewards? I’d love to hear more about how you adapt your strategy for different spending scenarios. Your insights are so practical—thanks for sharing!

Navigating credit cards can indeed be overwhelming, but your approach to focusing on miles is intriguing. Consolidating cards under one bank seems like a smart move to simplify tracking and reduce fees. I’m curious, though, how do you handle situations where another bank offers better rewards for specific categories? Your strategy of prioritizing higher-value spending makes sense, but do you ever feel limited by the card’s restrictions on online spending categories? Also, how do you decide which travel programs to redeem your miles with? I’d love to hear more about your experiences with pooling miles and whether you’ve encountered any challenges. What advice would you give to someone just starting to optimize their credit card usage for travel rewards?

Navigating credit card options is indeed tricky, but focusing on miles is such a smart strategy, especially for frequent travelers. I’ve been trying to consolidate my cards under one bank too, and it’s made tracking expenses so much simpler. Your point about minimizing transfer fees is spot on—those small charges add up quickly! I’m curious, though, how do you decide which spending categories to prioritize when accumulating miles? Personally, I’ve found that sticking to one card for online purchases works well, but I’d love to hear if you’ve noticed any exceptions or tricks. Also, do you think this approach would work for someone who doesn’t travel as often? Your insights are super helpful, but I wonder if there’s a way to adapt this for cashback-focused spenders. What’s your take on that?

This is a really insightful breakdown of credit card strategies, especially for someone like me who’s just starting to explore the world of miles and rewards. I appreciate how you’ve simplified the process by focusing on consolidation and minimizing fees—it’s something I’ve been struggling with. Your emphasis on “Team Miles” makes a lot of sense, especially for frequent travelers, but I wonder if this approach works as well for someone who doesn’t travel often. Have you ever considered how this strategy might adapt for someone with different spending priorities, like cashback or retail rewards? Also, the point about PayWave transactions is interesting—do you think this card would still be worth it for someone who doesn’t frequently make large purchases? I’d love to hear your thoughts on how to balance these factors for different lifestyles.

Navigating credit cards can indeed be overwhelming, but your focus on miles is intriguing. I’ve always wondered if consolidating cards under one bank truly outweighs the benefits of diversifying across multiple banks. Your strategy of minimizing transfer fees makes sense, but doesn’t it limit the flexibility of earning rewards in different categories? I’m curious, have you ever encountered a situation where a card from another bank offered significantly better rewards for a specific purchase? Also, how do you handle spending in categories that your primary card doesn’t cover? Your approach seems efficient, but I wonder if it’s adaptable to unexpected spending habits. What’s your take on balancing simplicity with maximizing rewards?