Dear Readers,

SATS reported a good set of results before market opened on Thursday. Despite the challenging business environment and softening of tourism growth, they achieved a net profit of $51.6mil for the quarter, up 18% against the same quarter a year ago. Consequently, operating profit also improved by 7.2%. Final dividend of $0.09 was proposed.

One day after the release, SATS had a good run to $3.38 and to close at $3.30. At closing price, it is trading at 2.5 times book value with earnings multiple of 18.75 times. Dividend yield stands at 4.24% (Source: Bloomberg). Under such valuation, is it still worth buying? If yes, for dividend/growth or both?

Dividend Stock

As investors, we all love dividends. Other than excitement from seeing

stocks that you own rise higher and higher in the stock market, getting passive dividend income from your investments every year is something we all look forward to. Don’t you agree? 🙂

1. Low Capital Expenditure (CAPEX)

As a dividend investor, I prefer to lookout for stocks with low CAPEX, which are funds spent by companies to purchase or upgrade fixed assets such as properties, industrial buildings or equipments.The expenditure also includes repairing or restoring assets to extend its useful life.

A company with high CAPEX means that it has to continually reinvest its

profits to invest in fixed assets to maintain its business operations, which means there could be lesser dividends to be distributed. You can find this in Cash flows from Investing Activities under the Cashflow Statement. Hence for dividend, search for companies that’s able to sustain/grow its business with minimal CAPEX.

In the case of SATS, their capital expenditure is made up of:

1.Additions of property, plant and equipment

2. Additions of intangible assets

3. Accrual for additions of property, plant and equipment

Consistency is also something to look out for. If the past few years’ expenditure changes very little, chances of it falling within the range for next few years is higher , which makes it more predictable.

Let’s look at SATS Capex over the past few years:

As you can see from the below, the capital expenditure is relatively low as compared to Free Cash Flow (FCF)

2. Stable Free Cash Flow (FCF)

Free cash flow (FCF) represents amount of cash the company generated for its shareholders to distribute dividends ,etc, after paying for expenses (salaries, utlities costs, supplies) and capital expenditures. FCF equals to Operating Cash Flow minus capital expenditures;hence a company with low capital expenditure could also lead to a higher FCF. A company could be earning alot a year, but until we look into the free cash flow, we won’t know if the company’s really generating cash from its profit. Ultimately a company must have real cash to pay dividends. If the company is profitable yet has negative or inconsistent FCF (high receivables), it will have troubles paying stable dividends.We can also tell from the chart above that the free cash flow is stable over the past 5 years.

Remember: free cash flows represent real cash, not earnings.

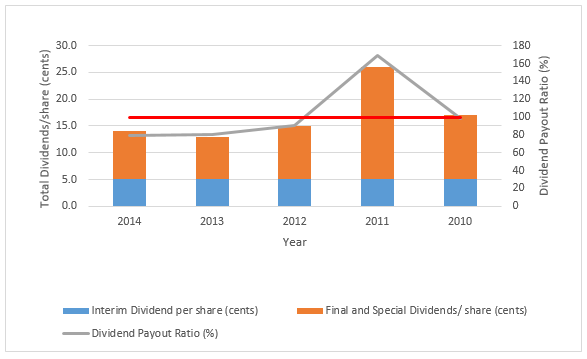

3. Sustainable Dividend Payout Ratio

Here’s the formula dividend payout ratio:

Dividend payout ratio is proportion of dividends paid to shareholders relative to the amount of total net income of a company. The payout ratio can

also be expressed as dividends paid out as a proportion of cash flow.

The payout ratio is a important in determining the sustainability of a company’s dividend payments.

A lower payout ratio is

generally preferable to a higher payout ratio as a company as the cash could be reinvested in capital for growth or repayment of debts. The amount that is not paid out

in dividends to stockholders is held by the company for growth.

Interestingly, there was a spike in dividends in Yr 2011 and yet the profit and revenue was down from the year before. The annual report also didn’t justify on it’s payout ratio. I look through all the Yr 11′ announcements and found that one possibility could be the disposal of its UK non-aviation food business, where they were paid £151 million (approx $300mil) and potential additional deferred consideration of up to £13 million over the next two years. No increase in net profit due to a loss on disposal yet increase in Cash Flows from Investing Activities. (see below)

In short other than Yr 2011, the dividends are sustainable and there was even a

decrease in payout ratio in recent years which suggests a hint for

future growth.

Catalyst for growth/earnings

1. Productivity and innovation to drive growth

Driving productivity & improvement → keeping operating costs low →building a internal strong foundation → strengthen and grow businesses.

The chairman highlighted in Annual Report ’13 that SATS was focusing on strengthening and growing their business through having a strong foundation internally. The current challenge is to minimize operating costs due to the inflationary pressure on costs. Hence they are constantly finding ways to improve productivity and innovation through upgrading their workforce and the use of technologies such as self check-in for passengers via process automation, driver-less ground support equipment and investing in robotics in kitchens which all lowers operating costs where rising staff costs is concerned. This will results in better earnings/excess cash which could be used to fund for growth.

In the recent quarterly earnings, operating expenditure declined by 3.2% partly also due to productivity measures supported by technology implementation. Seems like their plans have yielded positive results and they are on the right track . More savings could also mean more dividends too, haha!

2. Asean Open Skies Policy

The ASEAN Open Skies Policy is a policy aimed at achieving a single aviation market in Southeast Asia. Also known as ASEAN Single Aviation Market (ASEAN-SAM), it came to effect on 1st of Jan this year which is intended to liberalize air travel between ASEAN countries, allowing airlines flying in/to those regions to benefit from growth in air travel ; if successfully implemented ,will not have regulatory limits on the frequency or capacity of flights between international airports towards the 10 ASEAN countries. This,in hand will also lead to more connectivity between aviation markets which should lead higher traffic growth, benefiting SATS in their gateway services by growth in flights and cargo tonnages handled.

Despite the implementation; it is not without obstacles. Indonesia for instance are still holding back third and forth freedom rights and air fright services too. Progress is slow; but I believe it will achieve full liberalization that in time to come, which could add more catalyst to SATS.

Currently third ,forth and fifth freedoms rights have been implemented and leaving seventh freedom rights unresolved, i.e the right to fly between two foreign countries while not offering flights to one’s own country . Moreover fifth freedom rights wasn’t given full implementation. To read up on freedoms of the air, please click here.

In anticipation of more air connectivity, SATS has positioned Indonesia as a key priority for them. They hold a long term view and worked with JAS airport services to improve their airport infrastructure to have the ability to accommodate more traffic. They also acquired Cardig Aero Services (CAS) which owns JAS and catering business.

3. Infrastructure

Last year, a lecturer mentioned that the new Changi Airport terminal 5 is bigger than T1, T2 and T3 combined. Recently I did some Googling and found out it was true; and not only that ,it can house as many passengers as all existing terminals combined too. I believe the government have done their statistics and have projected the increase in travelers in years to come.

“Based on our projections, the capacity of our existing terminals and

the upcoming Terminal 4 will be fully utilised by the mid-2020s,” he

said. “Hence, Terminal 5 is our major project to ensure that Changi

Airport can meet Singapore’s future needs.” said the Minister for Transport Lui Tuck Yew.

Based on past growth and future

projections, Changi, which handled 54.1 million passengers last year, could hit

the 100 million mark by 2030, they said. – Source: http://www.straitstimes.com/news/singapore/transport/story/changis-t5-be-bigger-3-current-terminals-combined-20150304#sthash.l64kGNNW.dpuf

Terminal 4 will be completed in 2017 which will increase airport capacity by 16million to 82million passangers. Terminal 5 will double the existing handling capacity to 135 million passengers. Such developments represents opportunities for SATS to extend their partnership with Changi to handle more cargo.Also their focus on improving passengers experience through designs and process innovations will make travelers their favorite stopover place as well.

Will EOTS buy SATS?

Currently I am holding to 2000 shares of SATS (you can check my portfolio) and I am looking forward to collect dividends. At current price and yield of 4.24%, I still find the valuation attractive as a dividend stock and will consider adding more. Do note that business environment will continue to be challenging in the near term due to uncertainty in global economy and the growth will take time.

Thanks for reading my post. I am writing this to learn and share at the same time.

If you like what I’ve written, appreciate if you could support me by

simply liking my page by clicking here or at

the top right hand corner (in desktop view). I ll update my Facebook page when i post anything new or interesting insights to share 🙂

Goodnight!

Sources

http://www.businessinsider.sg/7-quick-steps-pick-best-dividend-stocks/#.VVhVIpNRSiw

http://www.investopedia.com/articles/stocks/05/031505.asp

http://www.investopedia.com/terms/p/payoutratio.asp

http://investorplace.com/2011/10/5-characteristics-of-a-successful-dividend-stock/#.VVhVAZNRSiw

http://www.sats.com.sg/Media/NewsContent/AN20-Apr-2004.pdf

http://news.asiaone.com/news/malaysia/asean-open-skies-%C2%ADpolicy-will-benefit-all-10-countries

http://www.aseanbriefing.com/news/2015/01/02/asean-open-skies-policy-implemented-2015.html

https://airlinesairports.wordpress.com/category/open-skies-issues/

operating profit improved 7.2 per cent year-on-year to $44.7 million. –

See more at:

http://www.straitstimes.com/news/business/companies/story/sats-q4-profit-jumps-21-516-million-full-year-earnings-85-1957-million#sthash.0uGWLcmZ.dpuf

operating profit improved 7.2 per cent year-on-year to $44.7 million. –

See more at:

http://www.straitstimes.com/news/business/companies/story/sats-q4-profit-jumps-21-516-million-full-year-earnings-85-1957-million#sthash.0uGWLcmZ.dpuf

operating profit improved 7.2 per cent year-on-year to $44.7 million. –

See more at:

http://www.straitstimes.com/news/business/companies/story/sats-q4-profit-jumps-21-516-million-full-year-earnings-85-1957-million#sthash.0uGWLcmZ.dpuf

operating profit improved 7.2 per cent year-on-year to $44.7 million. –

See more at:

http://www.straitstimes.com/news/business/companies/story/sats-q4-profit-jumps-21-516-million-full-year-earnings-85-1957-million#sthash.0uGWLcmZ.dpuf

operating profit improved 7.2 per cent year-on-year to $44.7 million. –

See more at:

http://www.straitstimes.com/news/business/companies/story/sats-q4-profit-jumps-21-516-million-full-year-earnings-85-1957-million#sthash.0uGWLcmZ.dpuf

operating profit improved 7.2 per cent year-on-year to $44.7 million. –

See more at:

http://www.straitstimes.com/news/business/companies/story/sats-q4-profit-jumps-21-516-million-full-year-earnings-85-1957-million#sthash.0uGWLcmZ.dpuf

p/s

There are many more growth drivers such as winning more cargo handling

contracts overseas and reasons for dividends but I couldn’t cover all

the points.

Updates of Singapore stock market

sgx nifty