It’s been almost 8 months since I last updated my portfolio. My desktop at home was down since mid of last year and I was also pretty busy and stressed with work. Today, I have decided to take a day off to rest and do some blogging.

There has been major changes in my stock holdings as I’ve initially decided to do some property investments in August of $100k, hence I sold away much of my shares . However, I changed my decision last minute due to some personal reasons. Hence, I am currently holding much cash and looking to reinvest again.

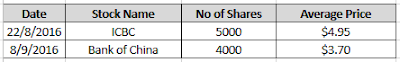

Here are the stocks I’ve sold.

Using factor of USD/SGD of 1.37 and HKD /SGD of 0.17654, total shares sold is about $69k. I saved up another $30k over another 3.5 months.

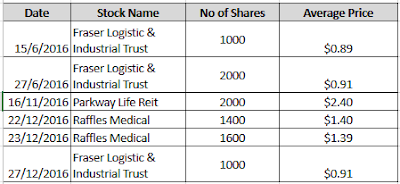

As I continue to save, I bought back Parkway Life Reit in Nov at $2.40 and 1600 shares of Raffles Medical in Dec at $1.385 at 1400 shares at $1.395, because only partial filled at market closing.

I have also added Fraser Logistic & Industrial Trust, with 1000 allotted shares via IPO. I couldn’t buy 3000 shares at once, because at that time I was trying very hard to save up $100k while minimizing the selling of shares.

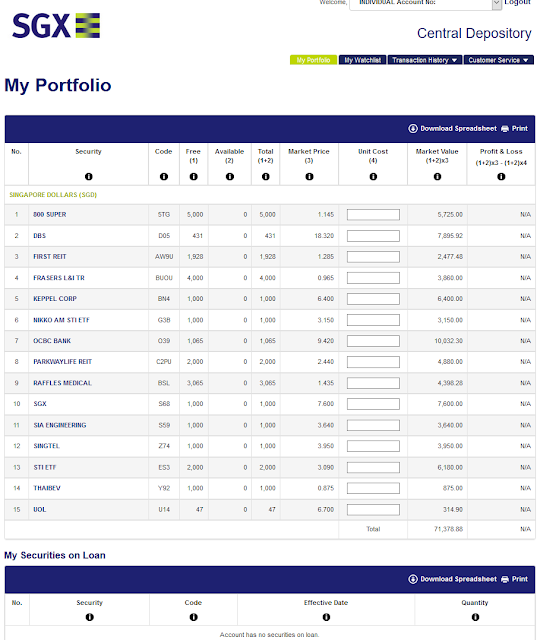

….and now I am holding much cash..

Sadly after selling the shares, STI traded sideways and subsequently had a good run from 2.8k to 3.1k. I am currently trying to buy back the shares that I’ve sold, but most of them went up quite abit, especially 800Super, trading at $1.145 (sold at $0.72), Sats at $5.00 (sold at $4.74).

Having the $100k cash, I was abit impatient and hungry for yields. I bought 3000 shares of Starhub at $2.98 for it’s 6.7% yield just before result announcement and kept my fingers crossed that the numbers won’t turn out so bad. But it turned out quite bad, and management had to cut dividends by 20% to sustain it’s cashflow. I sold away at $2.79.

Reason for selling: Dividend yield is only 5.3% at $2.98 ( $0.04*4= $0.16 dividend/year). A 5.3% yield with minimal/declining growth doesn’t fit into my investment criteria and I think I can get a better deal by investing in stable Reits with more growth potential such as Parkway Life Reit.

I have also read articles by investment bloggers. Shares they bought recently, e.g Kingsmen Creative, ISO Team, M1. Kingsmen Creatives has a very healthy order book, minimal debt and high free cashflow. However, I don’t seem to quite understand their business and the risks involved.

For now, I should be more patient and wait for opportunities. Perhaps the next market correction is just round the corner.

Individual Acc Portfolio (retirement fund)

Current Acc2 shares:

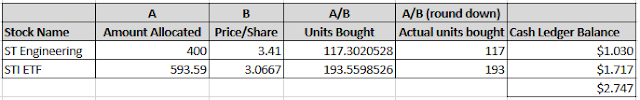

On Jan, I have also decided to take up the Phillip Share Builder plan, $1,000/month to sort of dollar costs averaging in STI ETF $600 and ST Eng $400.

For $600 and above, I would recommend Phillip Share Builder as compared to OCBC BCIP and POSB Invest Saver as the costs is lower. What I like most about share builder is it allows dividend reinvestment and the uninvested portion would be rolled over to the next month’s investment.

Here’s how ledger balance is being derived.

Cash Ledger Balance = [ A/B – A/B (round down) ]* B

On 2nd Feb, STI went Ex-Dividend (XD) of $0.053/unit. Hence dividend of 193*0.053= $10.229 (before dividend charge of 1%) and cash ledger balance of $2.74 would be reinvested next month.

Amount alloted for STI ETF is $593.59 instead of $600 is due to the fees of $6.41. ($6+ 7% GST).

If you chose more than 2 stocks, you can decide where the costs will be deducted from upon enrollment.

Hopefully the next time I blog, some of the shares under my watchlist would have hit my buy price.

Just a question for readers: I bought SATS at and average price of $2.93 to $3.10 and 800Super at $0.475. If you were in my shoes, would you consider buying back at higher prices?

Hi..

my humble opinion…what is the reason for you to buy back? if it is because of 800 Super' price has gone up, i do not think it is good to do so. But if you are buying back because you think the fundamental has changed to be much better and making current price is undervalued then it is good to do.

Hi, Agree with you. It's quite psychological coz I used to own those shares before, so I tend to actually focus on the price which I bought and sold.

Yes, I should me more objective and focus on the fundamentals and treat it as if I didn't own it before. Good to have someone remind and advice me once in a while, thanks! -EoTS