A Year of Growth and Conviction

2024 has been a year of growth, milestones, and strengthened conviction—both in my investments and in my approach to life. Each step forward has been like adding pieces to a puzzle, bringing me closer to the bigger picture of my goals. This year has been a pivotal one in my journey toward FIRE (Financial Independence, Retire Early) by 40, as I am now 55% of the way to my target of $3.9 million.

Reflecting on this progress, I’ve learned the importance of focus and discipline—whether it’s simplifying my portfolio, making sharper decisions, or staying committed to long-term goals. While I’m determined to achieve my FIRE target, I recognize the road ahead will not always be smooth. Volatility is inevitable, but I view these market fluctuations not as obstacles but as stepping stones—opportunities to invest in high-conviction stocks that will ultimately help me grow my assets for the long term.

Net Worth Update

I’m excited to share that my net worth has grown to $2.17 million, with a remarkable $170,000 increase in the last month alone, thanks to Tesla’s stellar performance. What’s even more striking is that a significant portion of these gains materialized in just the first two weeks of the month, a rapid ascent that felt like watching a spark turn into a blaze.

While the surge may appear sudden, it’s a culmination of years of preparation and conviction—staying the course, holding through volatility, and trusting in the long-term potential of my investments. It’s a reminder that, in investing, some of the most rewarding moments often come in bursts, fueled by the groundwork laid well in advance.

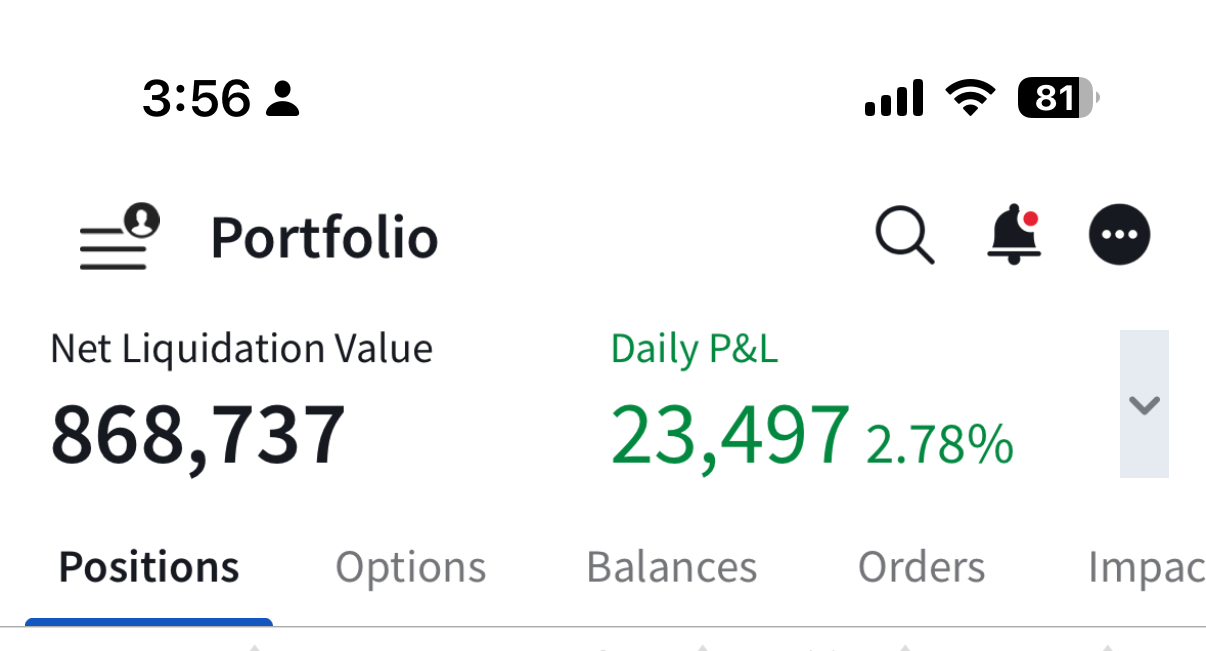

Here’s how my portfolio currently looks:

• Stock Portfolio: $874,600 (a $100,000 increase this month, led by Tesla).

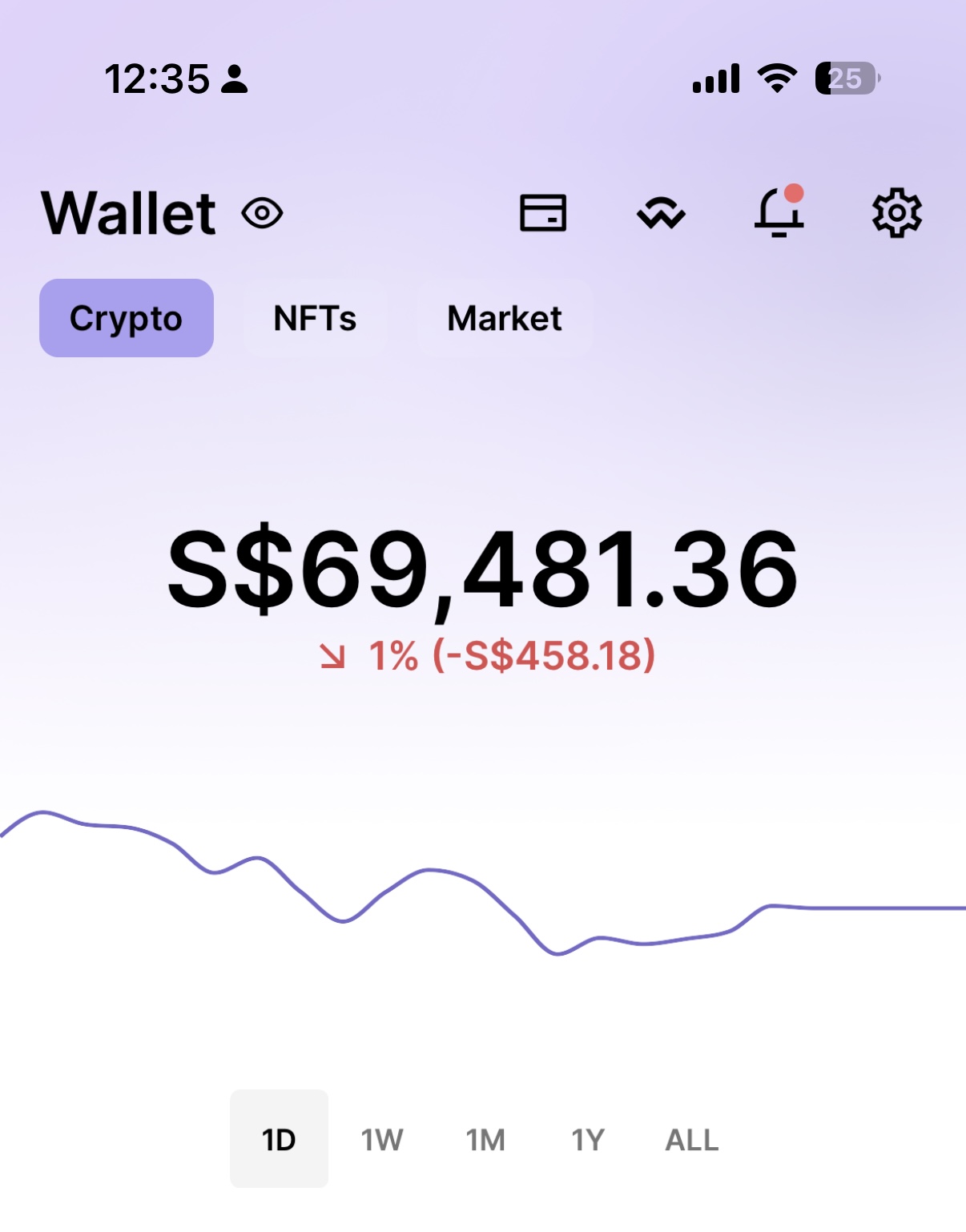

• Crypto Portfolio: $69,000 (100% appreciation over the year).

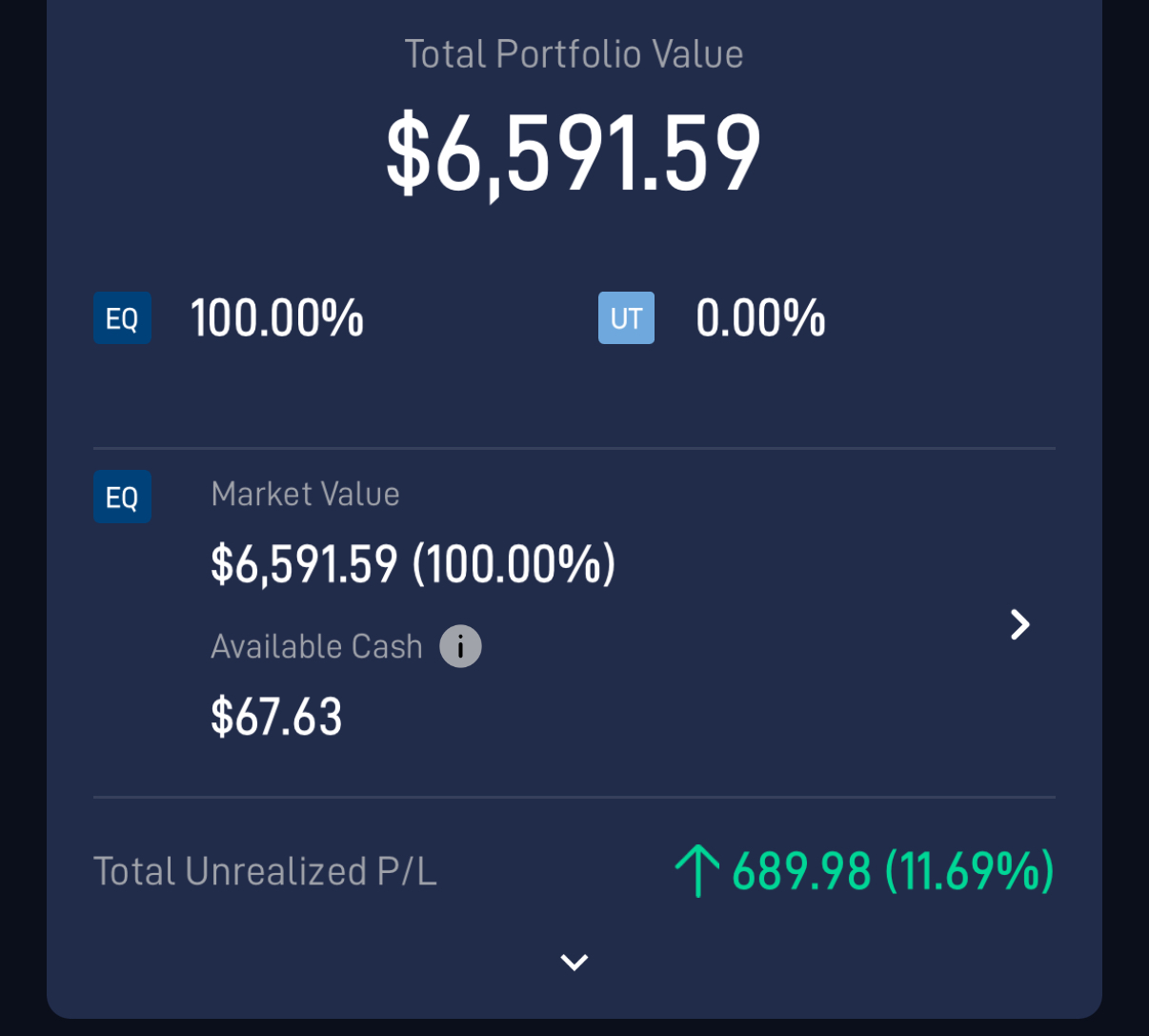

• SRS Account: $57,000 (growth without additional injections).

• Property Value: $1.29 mil (Net Equity – $470,000).

• Unlisted Securities: $700,000. These continue to generate $3,000 per month in passive income. While I don’t foresee significant appreciation in this asset, it functions well as a cash cow, consistently contributing to my cash flow.

Portfolio Updates and Investment Strategy

This year, my year-to-date portfolio return stands at 79.8%—a result I’m deeply thankful for. Such returns wouldn’t have been possible if I had followed a strategy of broad diversification. Instead, I’ve embraced the power of focus—allocating my resources to a few high-conviction investments that have the potential to deliver outsized gains.

In the past month, my portfolio grew by over $170,000, a surge largely driven by Tesla’s remarkable performance. While the growth has been extraordinary, I’m mindful of potential short-term challenges, such as weak sales in the US and Europe and recent concerns about Cybertruck demand. However, these headwinds do little to shake my long-term conviction in Tesla’s ability to innovate and lead in its industry.

Currently, Tesla, Shopify, and Palantir account for approximately 80% of my overall portfolio. These are the companies I deeply understand and believe in. The remaining 20% is distributed across other stocks that I’m still researching and monitoring, allowing me to maintain flexibility while refining my strategy. This disciplined approach has not only strengthened my portfolio but also reinforced my confidence in trusting my own research and decisions.

Property Update: A Plan for Rental Income

My property is nearing completion and is expected to be ready next year. Initially, I considered selling it to upgrade to a larger unit, but I realized that property is not within my circle of competence. Instead, I’ve decided to use it as a rental income source, with plans to rent it out in 2025.

This approach allows me to quickly build safe assets while channeling the rental income toward investments in high-conviction stocks. I believe this strategy has greater potential for outsized gains compared to property appreciation. It also aligns with my broader goal of optimizing cash flow and reinvesting in opportunities that can deliver exponential growth.

High-Conviction Investing: The Sniper Theory

When it comes to investing, I approach it like a sniper with only a handful of bullets—each shot must be deliberate, calculated, and well-planned. Imagine having just ten bullets to use in your entire life. Every detail matters: understanding the win condition, planning the escape route, and ensuring the shot is precise. This mindset forms the foundation of my high-conviction investing philosophy.

High-conviction investing requires focus and the ability to make decisions independent of market noise. For example, this year, Tesla’s stock experienced significant volatility, in part due to concerns over price cuts that raised questions about demand and margins. Analysts began downgrading the stock, and many investors were calling for a sell. It was a test of conviction—one that required me to trust my research, my judgment, and my belief in Tesla’s long-term potential.

Investing with conviction often means going against the grain. The bull is the herd. The bear is the herd. But the exceptional investor takes the lonely path. It’s about embracing discomfort and having the courage to hold firm when others are fleeing. Tesla’s price cuts, for example, weren’t simply a sign of weakness—they were part of a calculated strategy to secure market dominance, a perspective that many failed to appreciate.

This approach has reinforced my belief in the value of independent judgment. By focusing on fewer, carefully chosen stocks, I’ve been able to stay disciplined, confident, and resilient during market volatility.

Why I Have Conviction in Tesla

Tesla is more than just a car company—it’s a beacon of innovation, reshaping how we define value. Traditional value investors often approach Tesla like a conventional automaker, such as Ford or GM. Their models, rooted in old paradigms, judge Tesla’s worth through metrics like price-to-earnings ratios or delivery numbers, deeming it “overvalued.” But growth investors, like myself, see Tesla through a different lens—one that reveals its potential to breathe human-level intelligence into products, fundamentally altering their utility and significance.

As Elon Musk has pointed out, AI redefines the concept of value because it brings intelligence into previously static products. For Tesla, this means transforming cars from mere vehicles into intelligent robots capable of driving themselves, generating income as part of a robotaxi network, and making life more efficient. The difference is staggering: a Tesla with Full Self-Driving (FSD) is an asset that can work for its owner, while a traditional car is simply a depreciating liability.

This paradigm shift explains why Tesla, in my view, cannot be compared to legacy automakers—it’s in a league of its own. It’s not just a car company; it’s a leader in AI innovation that is redefining industries and reshaping the future of transportation and productivity.

Value vs. Growth Investing: Seeing the Bigger Picture

The gulf between value investors and growth investors lies in their focus. Value investors are tethered to the present, scrutinizing Tesla’s high price-to-earnings ratio or short-term challenges like delivery numbers. Growth investors, however, peer into the future, seeing Tesla not as a car company but as a harbinger of industrial disruption. Beyond automobiles, we see industries Tesla will transform: ride-hailing, logistics, energy, and even AI-driven productivity.

Earlier this year, Tesla’s stock plunged to $100, sparking panic and prompting analysts to downgrade their forecasts. For many, this was a moment of doubt. But as a growth investor, I saw a different story—a rare opportunity. The short-term noise from Wall Street was akin to static on a radio, obscuring the clear melody of Tesla’s potential. With conviction built on research and foresight, I added to my position, confident that Tesla was poised to redefine industries in ways traditional models can’t yet quantify.

A Redefined Concept of Value

Tesla’s Full Self-Driving and real-world AI are not just technologies—they are keys to a new frontier of productivity. If Tesla succeeds in solving FSD, every car becomes a robot on wheels, capable of navigating autonomously and generating income. This reimagining of a car’s role in daily life is why I believe Tesla is misunderstood. To those bound by traditional metrics, it appears overvalued; to those who see its potential, it is vision underpriced.

Tesla’s potential stretches far beyond transportation. It is a company building tools that will make life more efficient, industries more dynamic, and progress more exponential. It’s not just leading a revolution—it’s architecting a new era, one where products are no longer static but intelligent and alive with potential.

Taking Care of Health and Reflecting on Life

Beyond my financial journey, this year has also been about prioritizing my mental and physical health. I’ve come to deeply appreciate the saying, “health is wealth.” Achieving financial milestones is meaningless if I don’t have the health to enjoy them and live a fulfilling life. I’ve focused on eating well, staying active, and making time for self-care, ensuring that I’m building a strong foundation for the years ahead.

On a personal note, this has been a year of reflection and self-discovery, especially when it comes to personal relationships and personal growth. I’ve spent time understanding what truly matters to me—whether it’s fostering meaningful connections or aligning my life with my values and goals. This journey has reminded me to stay grounded, trust the process, and embrace the timing of life.

While there have been moments of uncertainty, they’ve also been opportunities to learn more about myself and what I’m looking for in the years to come.

Looking Ahead: A Special Year to Celebrate

This has been a special year—a year of growth, achievements, and lessons. To celebrate, I decided to splurge a little. I bought myself a Moncler Grenoble ski jacket and a new ski helmet in preparation for my upcoming ski trip to Hokkaido. I’ll be heading there in less than two weeks for some much-needed relaxation. Skiing has always been a passion of mine, and I’ve been practicing indoor skiing to ensure I’m in great condition for the trip.

This time away will also give me the chance to reflect on my progress and plan for 2025. It feels like the perfect way to end such a fulfilling year.

Final Thoughts

As I was wrapping up this blog post, a familiar melody floated through the air—a Christmas song playing outside my window. It reminded me that the season of giving and reflection is upon us, and with it, the close of another year. The music felt like a gentle nudge to pause, appreciate the moments that have passed, and look forward to the opportunities that lie ahead.

I want to take this opportunity to wish you a Merry Christmas and a Happy New Year. This time of year is perfect for reflecting on our journeys, celebrating our milestones, and setting intentions for the future. For me, it’s been a year of growth and learning, and I hope the same has been true for you.

What about you—how have your financial goals progressed this year? Have you started thinking about your aspirations for 2025? Whether you’re taking your first steps or already advancing steadily, I’d love to hear about your journey. Feel free to share your thoughts in the comments or reach out directly.

As we step into 2025, here’s to making it a year of new beginnings, meaningful progress, and fulfilled dreams. Let’s continue to grow, inspire, and celebrate every small and big win. Cheers to you, and may the holiday season bring you joy, peace, and prosperity!

It’s inspiring how patience and long-term vision can lead to rewarding outcomes in investing. Staying focused despite market volatility truly pays off over time. Tesla’s potential, despite the short-term noise, highlights the importance of research and conviction. The personal reflection on growth and achievements adds a meaningful touch to the financial journey. How do you plan to balance your passion for skiing with your investment strategies in the coming years?