|

| https://www.ft.com/content/6627a239-e3b4-43bb-995b-6b4f4d09d3bd |

As I have not been feeling too good recently- physically and mentally, I will be keeping this blogpost short and updating my net worth and how my portfolio has been performing lately for the month of August. After this, I still have to get back to work, as I have been behind time due to some sort of insomnia.

I had a quick look at my transactions for August; majority of the transactions are buying the Chinese tech companies- Alibaba, Tencent, and Bili Bili. Despite the fear of China’s big tech regulation, I see it as an opportunity to add more to my position at such attractive valuations. Every now and then, when news on big tech regulation is being publicized and sensationalized in western news media, the Chinese tech stocks will drop by a few percentage points. If one could objectively think of the impact of regulation on the internet companies and do a proper valuation with a wide margin of safety, even the conservative investor would discover that these shares are trading at quite a bargain.

I started a small crypto position this year and have been DCA-ing and HODL-ing when share prices tank. However, it has since made a comeback and has almost crossed $10k. Since it has crossed more than 1% of my overall portfolio, I will be including it in my monthly portfolio update from now on.

Recent Chinese Tech Purchases (average cost price and total shares)

In the spirit of sharing (because sharing is caring) and transparency, I will update this on a monthly basis till the Chinese software companies have recovered.

In alphabetical order, starting with Alibaba

Next up, Bili Bili,

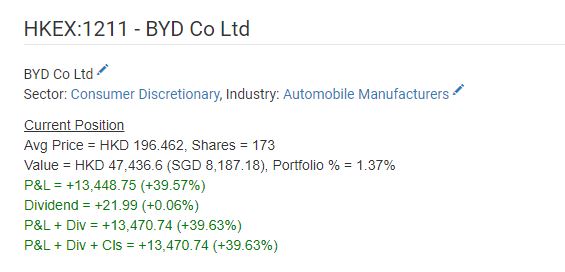

BYD

JD.com

Sunny Optical

Last but not least, Tencent Holdings

Dividend Portfolio

There have been no changes other than selling off Link REIT to fund my Tencent Holdings purchase. The move paid-off well, as I sold it off at $74.25 HKD, a return of 8.88%.

Growth Portfolio

These are the few companies which I average-down my position after they have reported disappointing earnings results.

Lemonade

Fiverr

Peloton

Amazon

My conviction in these companies is strong and I am looking beyond one quarter of earnings. This year, the stock market hasn’t been kind to small and mid cap tech companies. Although Nasdaq had a good run in the past eight months, the index surge is mainly driven by FAANG stocks. There are a few companies that I do not plan to hold for the long run, such as Netflix, Qualcomm and Apple, to name a few, but current market sentiments are favouring these mega cap companies, hence, I will hold on these stocks for a bit longer.

Companies which I added and performed well in the last earnings quarter

Airbnb

Tesla

Roku

Crypto Portfolio

Currently, my crypto portfolio only consists of Bitcoin and Ethereum. Will be looking at FTX token and Cardano.