Pinterest’s latest earnings report is ambiguously

described as a mixed bag of results, and that sends its share price down

sharply in a single trading session. A twitter user even jokingly tweeted that

the market is so quiet that you can hear a “pin” drop.

Most of the metrics reported by Pinterest had

beaten analyst expectations by a landslide. For instance, revenue was $613.21

mil USD, up 125% year on year (consensus $562.13 mil USD), ARPU was $1.32 USD

up by 89% year on year (consensus $1.17 USD), and adjusted earnings per share

(EPS) of $0.25 USD (consensus $0.13 USD).

Unfortunately, the metric that mattered the most

to analysts was the monthly active users (MAU) – a paltry 454 mil users

compared to 482 mil forecasted by Street Account. The prior quarter’s MAU was 478

mil, which translates to a 24 million drop in MAU, and that is a significant

loss by all accounts. Management has reiterated that the fall in MAU was due to

the Covid 19 effect, as many users were spending more time outside rather than

surfing the net in the comfort of their homes. Management estimated that the

following quarter MAU growth will be muted. According to their estimates as of

27th July, international MAU growth of 5% and US MAU decline of 7% further

proved that the slowdown is real, and gave investors the impression that

management is more focused on growing its bottom line at the expense of adding

more users.

The selloff showed that shareholders were

probably feeling despondent and very concerned that the company had reached its

peak growth, which may lead to a decline in MAU in subsequent quarters.

After the earnings release, stock celebrity

Cathie Wood attempted to bring lifeboats to Pinterest’s sinking ship by buying

$9 million USD worth of stocks, but even that was not able to save shares from

drowning.

Till today, there has been much negativity

surrounding the prospects on Pinterest with the share price resuming its

downtrend. After doing a deep dive on the company, I continue to believe that

the visual content company is still in its early stages of growth. With its

effective monetization strategies and innovative and exciting features,

Pinterest will continue to capture new markets to grow its users.

A One-Time Covid 19 Effect

When valuing a company, extraordinary items are

often excluded in the calculation because it is a one-off event and not

expected to repeat in the following years. Also, companies often separate

one-time gain or loss from their operating earnings to give investors a sense

that it does not happen frequently. Thus, I tend to view Pinterest’s MAU dip in

a similar fashion, as a one-off event due to Covid 19’s effect and an upward

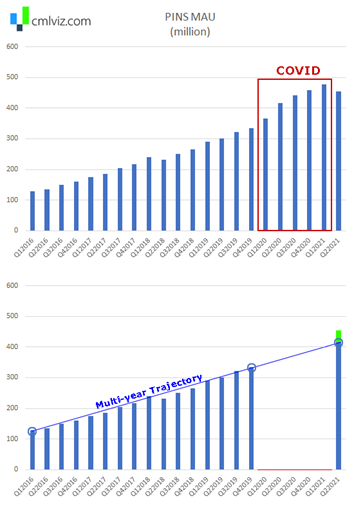

trajectory in adding new users. The chart below, which I have also posted in my

previous blog post, shows it all. Last year, Pinterest was obviously

benefitting from Covid 19 lockdowns, as it adds many MAU who were stuck at home

and naturally spending more time on social media like Pinterest. This increased

screen time had resulted in a one-time spike in MAU. Imagine Covid 19 did not

exist, and Pinterest did not benefit from the surge in MAU – then Pinterest MAU

would paint a different picture showing that its MAU is ever-growing.

To the surprise of many, this is not the first

time that Pinterest showed a drop in MAU. In 2018, when Pinterest was not even

listed in the stock exchange and its innings of growth, there was a drop in MAU

in June in comparison to its prior quarter. Yet, Pinterest continued to show no

evidence of slowing down and the global MAU rebounded to 9%.

Secondly, management has also explained the user

loss was attributed to users who visit the visual discovery platform on their

desktop rather than mobile. These are the users who, in the words of

management, ‘tended to be, on average, less engaged and generated less revenue

than people who came directly to Pinterest.’

What’s more impressive is that there has been a

double-digit growth in Gen Z users, despite the dip in MAU. According to

Forbes, the way Gen-Z shops is very different from millennials. Instead of ecommerce

shopping, which is favoured by millennials, 67% of Gen-Z prefers social

commerce shopping, i.e. Tik Tok, Instagram and Pinterest. Also, 30% of Gen Z

said that a seamless checkout process is important in their shopping

experience. Imagine yourself in the shoes of a Gen Z-er, browsing through your

feed and seeing the jacket that your favorite influencer is wearing. Within a

few clicks of an integrated shopping function on your social media page, you

bought that very same jacket through a seamless checkout process. Therefore,

Pinterest’s recent partnership with Shopify is indeed moving in the right

direction which ensures a smooth and secure payment process that does not

request for shoppers’ financial details. With that being said, I believe

Pinterest will continue to add more Gen Z users on its platform to fuel its

further growth in MAU in years to come.

Huge Monetization Opportunity and Growth for International Market

Though there was a MAU slowdown in the US,

international MAU continues to grow at 9% year on year. Furthermore, management

has guided a growth of 5% international MAU for the month of July. Considering

that the Covid-19 pulled forward in demand, I think the numbers are

encouraging.

Revenue is approximately MAU x Average Revenue

Per User (ARPU) and MAU only shows one side of the equation. The huge ARPU gap

between US and International markets just shows how much ample room there is

for monetization.

The chart below shows the APRU between

International users and US users and that huge disparity suggests that there is

ample opportunity for ARPU in international markets.

The US ARPU is 14 times the ARPU of international

markets, and if ARPU in international markets could reach 50% of US ARPU, with

all else staying constant (i.e. 0 growth in MAU) Pinterest could bring in additional

revenue of $922 mil USD in international markets alone, and that is 150% of the

current revenue.

When ARPU for the international and US markets

are placed side by side, it looks as if the international markets are not

growing – but don’t be fooled by the relative comparison. After separating its

ARPU, it is evident from the chart that ARPU is growing exponentially.

Advertistments Accurately Targets The Right Audience

According to a study (paste link here), 89% of

users are on Pinterest for inspiration for their next big purchase. Since users

visit Pinterest with the intention to make a purchase, it’s easy for merchants

to push the right advertisement to Pinners based on their searches and favourite

pins saved. However, the same cannot be said for traditional social media such

as Facebook, Instagram, or Snap, where users visit the platform to check out

the latest social life of their friends, and they are not able to push the

right advertisement to the viewers. More so, advertisements are probably seen

as a form of distractions. That also explains the statistical report that users

are three times more likely to click over a brand website on Pinterest compared

to other social media websites.

What truly separates Pinterest from the

traditional social media is its Pinterest Lens and its AR Try on. The former lets you discover ideas or inspiration with whatever your Pinterest

lens are pointing at. For instance, snapping a picture of a stranger who wears

a nice jacket which excites you will yield the result of the item that you

need, resulting in a quick buying decision.

|

| Source: https://martech.org/pinterests-lens-app-turns-phones-camera-search-bar/ |

Imagine trying on a product at the comfort of

your home before even purchasing it – that’s the word possibility of AR Try On

unlocks. With the help of AR technology, Pinterest allows you to try on

different shades of eyeshadows and shop for beauty products and purchases in

the convenience of your home. Management has hinted that there will be more AR

features rolling out which could further drive numerous online purchases.

Hence, it is not surprising that 48% of US respondents named Pinterest as the

shopping platform of choice.

|

| Source: https://techcrunch.com/2020/01/28/pinterest-launches-virtual-makeup-try-on-feature-starting-with-lipstick/ |

I took the sell-down opportunity to ‘buy the dip’

and average down my current Pinterest holdings. Currently it is trading at a one-year

low price to sales of 15.51. From a technical analysis perspective, it is

sitting at a horizontal support line that could portend a short-term rebound.

The current valuation is attractive considering that there is significant room

for growth in ARPU in international markets to drive up revenue. Its MAU is a

closely watched metric in the following quarters, and I believe that downside

risk is limited even if user growth stalls as the company already is already free cash

flow positive and its GAAP income is on the green. I will be sharing the valuation

of Pinterest in my next post, and hopefully the price has recovered from such a

depressed level, so stay tuned!

Thank you so much for spending time to read my blog and I really appreciate you. If you enjoyed reading my blog, hope you can support me by liking my Facebook page here or share my post. You may also follow my Twitter account here, where I post my buy and sell transactions. Currently, I do not earn any fees through any affiliate programme or sponsor. If you have any queries, feel free to post them and I am happy to take questions! 🙂

very good thought process. I learned:)