Hi Readers,

As promised , here’s the writeup on First Reit.

To be very frank, I just read the annual report before writing this and I admit that before i bought this stock, I didnt really do alot of homework to understand it due to my work and study commitments.

What made me decided to buy this was these few simple reasons:

Why did I buy?

1. Management has been actively buying

-It’s always a plus point to me when management start buying the shares. The management understands the company and he himself buying means that he believes in the company that he is managing. Before I bought this share, I observed that Dr. Ronnie Tan, the Director and CEO of First Reit has been continuously buying the share at about. $1.325 on 18th Feb (highest). The last transaction being 4th of March 15′ where he participated in DRIP. I still see $1.30 levels being attractive.

-2. Healthcare is defensive and it was giving a dividend yield of 6.7% back then at $1.17

I am happy with foregoing some 1-2% of dividends for something more defensive.

3.100% occupancy

(from 2008-2014 and counting)- check their annual reports here

Even during bad years they could still maintain their 100% occupancy

4. Rentals denominated in SGD

Despite having overseas exposure, a weakening Rupiah doesn’t affect the distribution as leases are denominated in SGD.

For South Korea, its been paid out in USD.

5. increase in dividends payout

I believe the key is consistency. It’s a bonus point that their distributable amount has been increasing even during Lehman financial crisis where the share price drops to about $0.30+ per share. Do note that there was a right issue which explains why the distributable amount drops as the outstanding shares were diluted

6. DRIP

I love to reinvest my dividends and this company has this dividend reinvestment since end of 2013 and distribution and share price has been going up despite the dilution. and somemore I’m getting at a 3% discount to stock price

7. More demand for healthcare services and nursing home occupancies

(read below)

When and how did i buy?

I am not too sure if you’ll remembered when Fed was talking about rising interest rates back then and emerging market took a toll. Rupiah weakened and First Reit’s price got hit as well.

That was when I saw the opportunity to went it because the rental was collected in SGD.

What’s to know about First Reit

1. Going XD this Monday

which means that you are entitled to dividends if you still hold the shares after market closes on Friday (as in last Friday). And those who are buying this Monday are not entitled to dividends.

2. Their LeaseHold is only about 10.1

I just saw this while browsing through the website. I guess it wasn’t shown in the annual report but they did write about the Leasehold for all their properties.

Well what happens after a lease Expires?

Well in theory when the lease expires then you don’t own anything

anymore- that’s it, you have to move out and the freeholder can sell a

new lease to someone else…or is there a right of renewal? I am not sure though.

But this explains why they introduced DRIP, placement shares, and right Issues.

DRIP- every quarter since end of 2013

Placement- once in 2012 and in 2014

Rights Issue – once in 2010

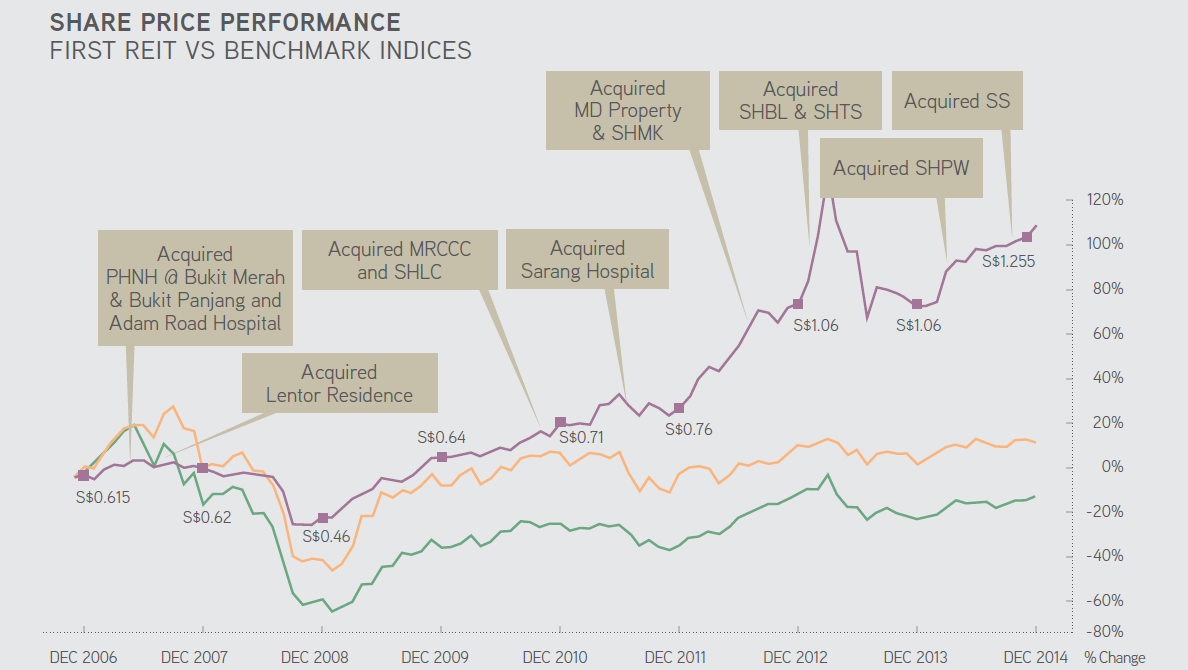

From the above figure, it’s evident that they have been aggressively buying properties and expanding from the amount funded…and this is their forward plan. They have even identified potential properties to be acquired too…

In my opinion, the 10.1 of WAAP is indeed quite low, compared to

Parkway Reit, which is also trading at p/b of 1.5 but they had more

exposures to Singapore and their Japanese properties are freehold.

Within my knowledge, the only plus point that it has over Parkway Reit

is their yield of about 5.8%. If it appreciates to about 4.9% yield, I

ll rather buy more Parkway Reit should I be looking into Reits.

Going Forward…

So moving forward, highly likely one can expect more share placement and continuous

DRIP to fund their future acquisition plans. It is the right move to go

considering that once property lease ends and my best guess is they gonna

let go, or pay a sum to acquire it again for a certain number of years.

So far, we can see that the management has really done an excellent job. They have really returned alot of value to shareholders, and even those who bought at peak in yr 12, should have made a profit by now. Result is the judge and they have made right acquisitions which increased their distribution every quarter.

Due to time limitations, I wont be writing about 1. prospect of the property they own relative to other properties in Indonesia and its valuation, as well as 2. their debt profile.

Honestly, with this low interest rate, coupled with the fact that there’s a need for them to acquire to increase their distribution, taking on some debt seems the right thing to do. Their interest coverage ratio stands at a healthy 5.3 times (down from 5.7 yr13) and debt-to-property at 33.1%.

Also I am not an expert in the property and so it’s up to the management to make the decisions & to comment on it. After all , or at least so far… they made very good decisions….

could have written more, but I gotta wake up at 6:30am for Sunday Church Service.

Feel free to write to me if you have any queries, or even to correct mistakes I have made.

I am an ordinary investor, just like everyone of you’ll who are still learning..

ACCICB used to have this stock and then sold it off too quickly… Which he regretted but oh well what to do. By the way I've linked you up in my blog (Googirl Investor)

Dear Joyce,

Thanks for the post. I ll also link you up too. Hope to learn from each other.

All of us make mistakes, but most importantly we learn from it and we become better the next time. 🙂