Dear readers,

Last week hasn’t been a good week for Singapore investors as STI was down to low 3.4k. But as I was scrolling through my watch list, one stock caught my attention: Capita Commercial Trusts at its all year low. I believe the sell-down was due to fear of looming interest rates hike when the US economy wasn’t performing. However Friday’s news showed some improvement in U.S. economy with the unemployment rate to all time low of 5.4%.

So under such economic situations, should we consider CapitaCom Trust/other Commercial Reits or avoid at all costs?

Fundamental Analysis for Capita Commercial Trust:

Reasons to Buy Capita Commercial Trust:

1. The above results have shown without a doubt that CapitaCommercial Trust

(CCT) has been outperforming the CBD occupancy rate for 10 Years since

inception. As we all know that office business rental is cyclical in nature

which is evident in 2009 and later 2011, CCT managed to secure occupancy

above 90%. So even in the last financial crisis, where the finance

sector got badly hurt, CCT still maintains an occupancy rate above 95%.

2. You might notice the occupancy dip in late 2014 to 2015. It’s not because their

occupancy has dropped;but the inclusion of CapitaGreen into CCT’s portfolio with occupancy of 69.9% and CapitaGreen

has only obtained ToP on 18 December 2014.

Excluding CapitaGreen, portfolio would be an impressive 99.7%.

But my point is that there could be more potential for distribution

increases as CapitaGreen continue to leasing out their remaining 23.6%. With 76.4% secured so far; it has more

spaces to lease out.

3. Another thing I like about CapitaGreen is the leasehold estate expiring 31 Mar 2073, which means that it can collect rents for another 58 years. Also take note that CCT owns only owns 40% of CapitaGreen

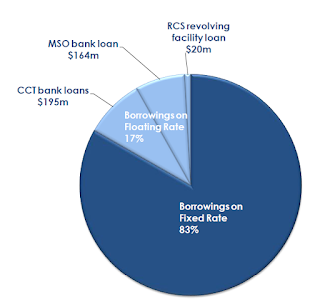

4, Next, 83% of CCTs’ borrowings are in the form of fix rates. ( see below)

Their current borrowings on fixed rate stands at 83% which means they are

not so affected by any rise in interest rates, at least 83% won’t 🙂

Well how good is 83%?

Here’s the table showing the borrowing on fix rate for Commercial

Reits in SG:

|

|

REIT

|

Borrowings on fix rate

|

|

1

|

Fraser Commercial Trust

|

87%

|

|

2

|

Capita Commercial Trust

|

83%

|

|

3

|

OUE Commercial Trust

|

72.50%

|

|

4

|

Mapletree Commercial Trust

|

70.60%

|

|

5

|

Keppel REIT

|

65%

|

For comparison purposes, I ll not include Suntec Reit for comparison purposes as less than 50% of their revenue is derived from commercial assets. (Suntec City and ParkMall)

Results: 2nd after Fraser Commercial Trust

5. Next let’s look at their gearing ratio.

|

REITs

|

Gearing Ratio

|

Credit Rating

|

|

Capita Commercial Trust

|

29.90%

|

A- (S&P)

|

|

A3 (Moody)

|

||

|

Fraser Commercial Trusts

|

37.20%

|

Baa3

|

|

Mapletree Commercial Trust

|

38.00%

|

Baa2

|

|

OUE Commercial Trust

|

38.60%

|

Ba1

|

|

Keppel REIT

|

48.60%

|

Baa2 (Moody)

|

|

BBB (S&P )

|

Keppel REIT uses aggregate leverage, hence I ll calculate gearing ratio

directly, taking debt/assets*100%

Results: CapitaCommercial has the lowest gearing ratio and only Credit

rating with both agencies giving As.

When a REIT is highly geared, it will be more adversely impacted when it comes

a time to refinance their loans at higher interest rates; which I believe it is

coming soon.

Whereas if a REIT gearing is low, it has potential for more property

acquisitions which collects more rental and increase distributions. It’s high

credit rating allows CCT to issue debt at lower repayment interest.

Technical Analysis for CCT

Upon closer look:

We can see that there’s still a long term uptrend and the support line is

not broken yet. As there could be a possibility of it touching the support

line; So does it present an opportunity to buy on weakness, or should we avoid

the stock for fears of it breaking the support towards a downtrend?

I am no expert in Technical Analysis (TA), though and from TA point of view;

I believe traders would adopt a ‘see and wait’ approach on how it

performs over the week or to buy after it has found it’s bottom. I am not too

sure if you can also notice a head & shoulders pattern formation; where it

has effectively broken the neckline and interestingly it is very close to the

250ma.

Other things to note about CCT

1. CCT owns 17.7% MRCB-Quill REIT, a commercial REIT listed in Malaysia

Stock Exchange.

Interestingly, with 17.7%, the holdings in MRCB-Quill REIT took up less than

1% of the Trust’s total assets. So it’s in someway or another quite

insignificant.

2. Although CCT only owns 40% of CapitaGreen as to date, they have a call

option to purchase the remaining 60% interest in their JV partners within 3

years after the building obtained their Temporary Occupation Permit.

We expect CapitaGreen’s occupancy to stabilise in the second half of 2015

and contribute to distributable income in 2016. Although CCT currently owns

40.0% interest in CapitaGreen, we have a call option to purchase the remaining

60.0% interest from our joint venture partners within three years after the

building’s achieving TOP.

In the news release on 21st Jan, Mr Soo said

Continuing with our disciplined approach to acquisitions, we will assess the

timing of the exercise of the call option with a view to enhancing the value

for CCT unitholders.”

Moving forward it seems like acquiring CapitaGreen is a just a matter of

time for them.

Will EoTS buy CCT?

I still have it under my watchlist. As I have limited funds for this month

and it’s also important to consider other stocks when opportunity costs is

concerned.

Recently this year, my dad trusted me to invest for him. Currently I bought

DBS and UOL for his trading account. Will be buying this stock for his

retirement fund. 🙂

Thanks for reading my post.

If you like what I’ve written, appreciate if you could support me by

simply liking my page by clicking here or at

the top right hand corner (in desktop view)

I ll post live updates on my twitter account: _eyeofthestorm whenever I

purchase any stocks or you can also click follow on the top right hand corner

(desktop view).

It’s already crossed Tuesday at this time of writing 🙂 Will write

more soon!

Hi EoTS,

I think you did a very nice analysis of CapitaCom.

I never knew that they had moved up in credit rating, I always thought they were BBB+. I know that their gearing is quite low, but I didn't know it was so much better than its peers! Less overall gearing + high % of fixed interest debt should mean that CapitaCom would be quite shielded from rising interest expense, should rates move up. That long term graph was just shocking though! Can't imagine this was a $3.xx counter before, haha!

I have nibbled at this counter recently and lower prices would tempt me to chase it! Is your current target entry price level at $1.58, the bottom of the support?

Hi GMGH!

Thanks for dropping by my blog; and your compliments 🙂

I have added 4000 CCT shares today at $1.635 for my dad's retirement fund as I am happy with the current yield.

Yup, initially I didn't know about their credit rating too till i did some research to do the writeup that day .

I am more of an investor these days,but I still like to catch stocks nearing support regions.I believe support is about $1.58-$1.60 . If it approaches $1.5+ I ll add more because the yield just gets more attractive. 🙂

Time is on our side when we own shares of superior companies so when people sell in May and go away; I ll buy in May and stay that way!!!!!

Hi Eots

Nice post on CCT.

I am not vested in CCT though I am vested in its rival competitor fcot ;).

My take on this is the company and assets are solid star performer and occupancy remains high even during recession but dont forget that the rentals at that time were brutally pushed down because of the situation. I just think that for retirement account there are perhaps less volatile reits than this so curious why you would consider this for retirement account. The yield isnt exactly that high too isnt it? Did you look into their capitalization rate compared to other commercial building?

Though there seems to be an endless supply of other shoes to drop into the current economic chasm, there seems to be a general consensus that commercial real estate is going to take a significant hit. The shoe that could end up kicking commercial real estate down further and is relatively unknown or just not thought about is technology.