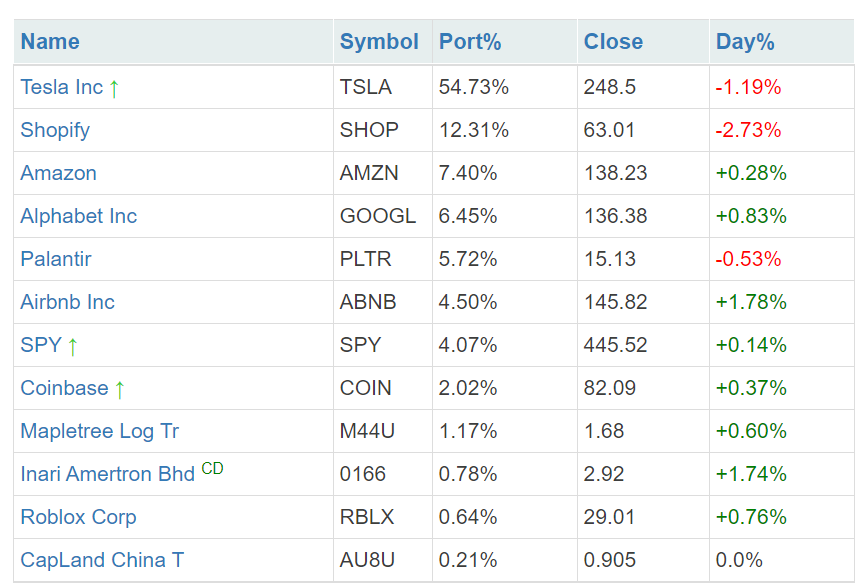

As September rolls in, it brings along a whirlpool of changes in my investment horizon. The past three months have been somewhat of a still water phase with the S&P moving along sideways. However, I took this time to reassess and realign my strategies, focusing heavily on dollar-cost averaging into Tesla and the S&P 500. Before we delve into the nitty-gritty, here’s a glimpse into the significant shifts in my portfolio.

Dividend Portfolio Overhaul

Earlier this year, I embarked on the journey of rebuilding a dividend portfolio, having picked some winners like the Parkway Life REIT at an acquisition price of $3.73 per share. However, I decided to undertake a significant overhaul of this portfolio recently. Now, only the Maple Tree Logistics Trust and CapitaLand China Trust (CLCT) remain, and even they are lined up to be liquidated soon.

Here are the three pivotal reasons behind this strategic shift:

1. An Urgency to Settle the Home Loan: As the SORA rates on my home loan is steadily rising, channeling the funds to pay it off became a priority, promising a guaranteed 4+% interest saving.

2. Career Shifts and Focus on Growth Stocks: The last couple of months have seen a roller-coaster in my career, nudging me towards focusing more on growth stocks to alleviate the stress that came with managing a diverse portfolio.

3. New Avenues of Passive Income: My upcoming property, ready by 2025, promises a significant rental income, overshadowing the returns from my REITs. Moreover, partially inheriting a private business from my father as a shareholder now brings another passive income stream, making the dividend earnings seem quite meager in comparison.

The proceeds from the dividend portfolio were judiciously used to max out contributions to my CPF and SRS accounts, fostering a secure financial path for the future.

Growth Portfolio and Crypto Insights

Despite the significant changes in my dividend portfolio, my growth portfolio has remained quite steady. My unwavering faith in Tesla continues to steer my investment decisions. Moreover, I’ve been dabbling more in the crypto space, contributing occasionally to my crypto portfolio, seizing opportunities whenever there’s a dip or when some funds are left idle in my account.

Looking Ahead

As we move forward, I foresee my updates focusing predominantly on the growth portfolio, especially with the promising trajectory that Tesla is showcasing. While the dividend portfolio has given me joy, the strategic shift seems a necessary step at this junction, aligning perfectly with my changing risk tolerance and the new passive income streams in my financial landscape.

Moreover, as I grow older, the thrill of picking the right REITs and witnessing the dividends flowing into my bank account every few months is something I still hold dear. While the decisions were tough, they were necessary, reflecting a matured approach towards achieving financial stability and growth.

Travelling and Mileage Hacks

On a lighter note, I am exhilarated to share that I will be flying to Osaka this Sunday, followed by trips to KL, Tokyo, and Hokkaido in December, all in business class, redeemed through miles! Stay tuned as I uncover some strategies to redeem business class flights for the busy bees out there.

For more updates on my travel ventures and investment strategies, don’t forget to follow my Twitter handle, @makesmewonder https://twitter.com/makesmewonder, where I will post live update whenever I buy or sell any shares, and stay tuned for my upcoming Instagram account which I will be launching soon.

Until then, stay savvy and keep investing wisely!