Hi Readers!

I ll be sharing all about Silverlake Axis today. I ll begin with some history about this company and its recent developments followed by looking into their financial statements.

Brief History

Founded in 1989, they started off as Axis Systems Holdings Limited ,providing front end software solutions such as ATM Front End Processing for banks and front end sales management system and became listed in Singapore’s Secondary Stock Exchange (SESDEQ) in 2003. Subsequently, they acquired Silverlake Banking Systems Solution in 2006 for 330million via share placement and renamed itself Silverlake Axis which now allows integrated end to end universal banking solutions through Silverlake Integrated Banking Solution (SIBS)

In 2009 the company acquired the remaining 75% of SBI Card Processing Co. Ltd (SBICP) from SBI Holdings to ease its penetration to the Japanese market and servicing their companies overseas.

It’s now named Silverlake Japan which provides outsourcing services for credit cards systems and operations for many countries.

They further expanded in 2010 with the official takeover of companies (announced in 2009): Structured Services Business (SSB) , and QR Tech. SSB contributes in application maintenance service portion to user of SIBS whereas QR Tech does developing, licensing, implementing, and servicing retail management systems to retail industry. QR Tech have a substantial clientele base and comprising large Japanese companies with operations overseas which they enjoyed that recurring income and could tap into their clients.

In other words, the purpose of all the acquisitions is to add depth and range to its existing core banking services. For instance with QR Tech, they could now market their services to conglomerates comprising banking and retail businesses.

Let’s look at one example on how such acquisition benefited Silverlake Axis. Link is here

In 2010, they secured two contracts with HNA Group (a large multi-enterprise Group) in PRC: cards and logistics IT Solutions. After the acquisition they could now fulfill the requirements of such conglomerates by tapping on the expertise of QR Tech for logistics department and probably Silverlake Japan (formerly known as SBICP) for the credit card solutions. Hence through the acquisition, they could also serve a variety of sectors/conglomerates other than just banks and financial institutions alone.

One year later they took over Isis International Pte Ltd, which principally engaged in computer software sales and provide technical support. Their rational for acquisition was that its Isis flagship EPOne and VCos Software Platform would complement SIBS Core Software Offerings in meeting

the complexity in digital economy business requirements.

In 2013 , they acquired 80% of Merimen with 20% in the form of call and put options. Their main business is provision of cloud computing software where they allow insurance companies to interact with clients in handling of claims and checking their policy and updates. Their value added service is also in providing secure connections between the server to computers and mobile phones which also complements SIBS with the increasing use of mobile and tablets with growing relevance of cyber security. With this acquisition, they could now serve insurance industries.

Within the same year, they bought over Cyber Village Sdn Bhd (CVSB), which provides internet and mobile financial service, customer loyalty and e-commerce solutions in various industries. Customers include BonusLink and Hong Leong Bank. This in turn would benefit Company as they can leverage on CVSB solutions capabilities to expand their client base.

|

| Software as a service via cloud computing – an illustration |

End of last year, they incorporated a new company in New Zealand – Silverlake HGH Limited to make a full take over of Finzsoft Solutions Limited. It’s principle service includes software development, hosting and services and SaaS (Software as a Service). By the way, SaaS works like a software, just that you access it through web browser instead of installing in your computer. Unlike normal software; it’s hard to come out with pirated versions to use it for free. Generally they get recurring income for maintenance and support services and of course licensing fees too. I see this becoming more relevant moving forward as Internet speeds becomes faster, and the need to be accessible on the go via mobile devices and tablets via cloud computing, which saves the need and time for software installation. Today many insurance solutions and Client Relationship Management (CRM) are deployed on cloud computing SaaS platform (picture). In the same year Finzsoft acquired Sush Mobile, with focus on helping companies develop innovative mobile apps with to boost work productivity or self service solutions; which means Silverlake effectively owns Sushmobile and Finzsoft.

Main Sectors

1. Banking

2. Insurance

3. Retail

Simply put, Silverlake is a provider of Core Banking Systems (CBS) which is basically a software for the purpose of supporting bank’s most common transactions such as processing cheque and payments, managing client’s accounts, keeping transaction records and calculating the interest rates etc. Prominent banks such as OCBC, UOB and CIMB are using Silverlake’s CBS.

|

| Silverlake Axis Integrated Banking Solution (SIBS) |

Initially they started off with Core Banking System which focuses only on the banking sector and subsequently penetrated into the insurance sector to provide a collaborative and information exchange platform for the insurance industry after acquring Merimen. They adopted the Software as a Service(SaaS) to improve efficiency in information exchange between different parties through the hub-and-spoke online model. Prominent clients include Etiqa Insurance, Aviva, Tenet Sompo. With the rising medical costs and aging population, there will be a greater demand for insurance. These days, filling up of insurance application forms are increasingly done with ipads and clients can track their claims status online through SaaS which makes Merimen’s Insurance Ecosystem more relevant than ever.

To cater for retail sector, they provide an integrated enterprise solution called PROFITTM for retailers to keep relevant and meet the challenges in the industry. For instance, tracking their business performance and managing transactions and suppliers where large number of stores are concerned. This will be very relevant with the rise in e-commerce, as more buying and selling processes are done online and hence a very efficient system is needed to track such progress and monitor the stocks supply and demand.

Operations

Next up, lets see how Silverlake Axis generates its revenue.

1. Software Licensing

This segment was originally named Licensing of SIBS in Annual Report 2011 and thereafter changed to Software Licensing. It is possibly due to the acquisition of QR Technology in 2010,enabling it to provide licensing of QR Retail Merchandising System (PROFIT) which also contributes to the software licensing revenue.

This segment has the highest and consistent profit margin of about 90% and I like the fact that this portion of revenue shown a steady growth and currently accounts for half of the total revenue. The source of revenue is mainly driven by securing new contracts from banking/retail sector or earning additional licensing fee from clients expanding their bank branches. This makes it very one off and the group have to continually secure contracts .Hence to sustain its growth they have been acquiring companies which provides software licensing to other sectors such as insurance and retail. In their website: http://www.silverlakeaxis.com/digital-economy-solutions.html, they are also software providers to many sectors such as healthcare and government, etc, which I believe could be future sectors they could focus on to propel its growth.

2. Maintenance and enhancement services

After software licensing, users have to pay a maintenance fee to continue using their service, which makes this revenue portion a more recurring and predictable one. Revenue could also be derived whenever there’s an upgrade or improvement in their software where clients pay enhancement fee. It is also the key contributor for revenue attributed from key existing customers in Malaysia, Indonesia and Singapore. So, going forward their revenue will be dependent on the majority of the renewed contracts and its ability to securing new software licensing contracts. The stable profit margin of 60% is also relatively high. Hence to stay relevant and have an edge over their competitors, they have been continually acquiring companies to improve their services such as SSB for maintenance and Finzsoft for their SaaS.

3. Software Project Services

This segment consists of software upgrades services and startup services and contracts could be derived from new and existing customers. Despite implementing new project services such as card system projects ,the revenue and profit for this segment has been declining over the years due to banks preference in reliance on internal resources to minimize costs. It’s profit margin was 40% and decreasing marginally.

4. Sale of Software and Hardware Products

This segment constitutes the selling and upgrading of software and IBM hardware as it serves as an authorized reseller of IBM hardware and earn rebates from the sale of it. It has all along occupy a small portion of the total revenue with relatively unstable net profit margin of 20%.

5. Credit Card Processing

It started off as a loss making till Yr 2012 where it reported a profit and subsequently net profit margin began to increase from there. It’s revenue contribution only came in after 2009 after acquired SBCIP has remained stable till Yr 2014 with 17% increase YoY. The loss was actually due to depreciation and amortization and not actual impairment loss. Today Silverlake Japan accounts for full scale processing of credit cards issued by its customers ie. services include credit card fraud monitoring, business fraud monitoring and processing of sales transactions. Their present clients are OCBC, UOB, Hong Leong Bank and Maybank. In my opinion, this segment would remain stable as long as these banks continue to outsource their processing services to Silverlake Japan. One point to watch out is the depreciation of PPE and amortization of intangible assets across the years. Though the cost has declined over the years but when it’s useful lives ended it will incur another one time huge costs.

6. Insurance Processing

Revenue for this segment only came in after acquiring Merimen in 2013. Going forward I forsee this to be a main driver for growth since more applications forms are filled online via tablets or PCs and many insurance companies have yet to fully upgrade and utilize online submission function. It’s cloud computing SaaS allows insurance companies to interact with clients and agents more efficiently and effectively especially where it comes to claims handling and policy updates get bounced back and forth. With increase in demand for compliance, application forms gets thicker and hence the use of cloud computing in submit applications online serve as a checker to ensure nothing gets left. With Merimen, medical reports could be directly sent to underwriters online instead of mails and telephone conversations in the future. Also clients will also get to check their policies and investment portfolio just a click away.

Recent Updates

1. Weakness in MYR

Currently the weakness of MYR actually benefits Silverlake Axis instead of the other way round because revenue is mainly generated in USD and SGD and cost in MYR. The analyst report by Maybank projected that every 5% depreciation of MYR against SGD and USD could lift its earnings by 4.5% and 1.2% respectively. Due to falling oil prices, I expect MYR to continue to depreciate against SGD.

2. Proposed Merger of 3 Malaysia Banks

The merger was believed to result in integration of software systems between three banks as CIMB is a client of Silverlake Axis leading to more software project services. However it was being called off in Jan 15 and sent the stock down lower.

Fundamentals

It is currently trading

at pe ratio of 25.01 and p/b of 11.17. Judging by both numbers alone

suggest that it’s overvalued but when valuing this stock one must look beyond the ratios. In overall, it has a high ROE and its propriety software is very capable of generating profits suggesting that it is actually worth more than its actual value.

This company has a strong moat as their clients are likely to continue using their services due to high costs in switching banking systems and software. During recession and economic crisis, we saw many business not doing well; but there won’t be much impact on SLA as banks like OCBC/UOB and insurance companies like Aviva & Takaful still have to keep their operations running and maintenance business will be recurring as long as they continue to use their software.

Through the growth via acquisition method, they managed to buy over companies which also helps to diversify their business so they would not get impacted greatly should one sector fails to perform. They also bought over companies that serves to complement their services to stay competitive.

The downside to it is its future growth being very dependent on software licensing segment which accounted for half its profit in Yr 2014. It also faces competition from its peers such as Oracle Corp and Fiserv Inc. Though they can remain profitable in bad times, one can expect their one off earnings to be impacted when they secure less contracts.

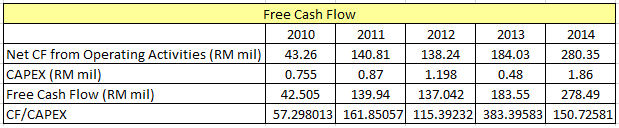

In fundamental analysis, other than evaluating the earnings per share one must also consider the quality of earnings, Free Cash Flow and their future growth plans. If not I would have also missed out a great stock trading at earnings ratio of 30 like Raffles Medical Group.

Dividends Payout

I also like their quarterly dividends payout too 🙂

Technicals

|

| Professionals taking the path of least resistance |

I added 2000 shares of Silverlake Axis on 14th of May :1000 at $1.285 and another at $1.29 after the stock tested 250ma and advanced higher with volume. 3rd quarter earnings was released next day with a 19% increase in net profit and 1.1 cents/share dividend was declared. Management proposed one bonus share for every existing five shares. The good result drove the stock price higher till 21st where it closed with a black Marubozu cutting through the 250ma with volume. Price recovered to $1.270 the next day with a white Marubozu with volume; a piercing pattern suggesting a bullish reversal.

However the tables turned last week. The stock broke 250ma for the first time since 2012 and effectively broke the immediate support levels at $1.20 with high volume supporting the move. When the volume is high with wide spread down punching through support line (see above), we can expect more down moves. Also do remember effort to penetrate the trend lines are usually seen as price apporach the line; not on the line because that institutions like to take the least amount of effort to cross the resistance. It is tough to push down the stock price on the support level as bottom line is a resistance to lower prices due to buying activities at the region.

Next support level is $1.12. Judging by technicals, it’s not a good time to long till there’s sign of rebound or till it holds well on a support level; unless you are a very long term investor like me who’s favorite holding period is forever 🙂

Note: All excel chart above was done up by me and values and information were abstracted from SLA’s Annual Report Yr 10 to Yr14

Thanks for reading this long post! I wish all Buddhist a happy Wesak day and the rest a happy and a restful holiday! 🙂 I am writing this to learn and share at the same time.

If you benefitted from what I’ve written, appreciate if you could support me by

simply liking and sharing my Facebook page by clicking here

or at

the top right hand corner (in desktop view). I ll also update my Facebook

page when i post anything new or interesting insights to share 🙂

hi i totally enjoyed reading your indepth write up of Silverlake Axis.Today, this share drops to 1.02 and seems it may drop further.I am vested and wanted to add on this share.. Just wondering does T.A. give further indication of how far it may slide. thanks

Thanks blazingruby60. I am happy to hear that you enjoyed reading my post.

By TA alone, i cant tell how far it can go but it looks very bearish to me and I suggest not to catch falling knives .

To average down at rebound/support , also make sure the volume is high to justify a reversal.

Hi EOTS,

Do u know why the sudden drop in pricing lately?

Hi Mr. Rolf!

Thanks for dropping by my blog.

According to Motley Fool, it could be due to the financial blogger's blogpost- “Foreword & Introduction: The Daredevil’s Case Guide to Detect Accounting Fraud in Asia- using Silverlake as a case study on fraudulent activity.

Silverlake then issued a statement to claim that the accusations were baseless and the blogger has then removed the post. I visited their website and the post is really gone.

http://bambooinnovator.com/2015/04/27/foreword-introduction-the-daredevils-case-guide-to-detect-accounting-fraud-in-asia/

http://www.fool.sg/2015/06/04/why-have-silverlake-axis-ltds-shares-fallen-by-nearly-30-in-2-months/#

In my opinion, the drop could be lack of contract wins as software licensing currently accounts for half their net profit. If I read correctly from SGX announcements, their last contract secured was on 26th Nov '14 in the form of software upgrading and haven’t got any for this year so far. So institutions are making use of this opportunity to take profit and accumulate at lower price.

Hi EOTS,

Thanks for the article and comments. This company interest me and I just read its AR and associated articles.

Price is not essentially cheap? But I like the fact that not many local bred competition, strong balance sht and great ability to generate FCF and pay out dividends.

Also it's in an industry not found in my current portfolio! I could well add some later…

Thanks again.

A great tumble today for silverlake!

hi EOTS

Bought more of Silverlake today at $1 thinking price has stablised but no it continued its slide to 0.955, what is happening to this share? Any new inputs to this share. Thanks and hope to hear from you.

Hi Mr Rolf!

Sorry for the late reply but hope you managed to scoop some at lows 🙂

Hi Blazingruby, sorry for late reply.

There wasn't any news prior to the drop except some management buying these three days but from technical analysis it's quite bearish after the support level is broken with high volume supporting the move. It's also trading below 250ma.

From the chart I can't tell if it's really recovering as the volume is diverging from the price action.

HI EOTS,

I would love to analyse a stock like how you do it…

Apart from the AR, what other information source u get it from?

How would you piece it out to make the data as a useful information?

If you're new to this industry, how would you be able to find out its competitors and etc?

THanks!

Dear Caleb,

Thanks for dropping by my blog.

Apologies for the late reply; I’m & (still) very busy with work and many things happened recently 🙁

Other than annual report, I obtained some info from analysts’ research by brokerage houses and financial institutions. When reading reports, you got to learn to separate facts from opinions.

I have been reading many investment books and writings by great investors and I manage to find my style of investing and to sieve out the important data.

Honestly, I am also pretty new to this industry but I read analysts’ reports to find out their competitors and visited competitor’s website to determine if it’s actually relevant.

You can access SLA’s analyst report here: http://www.silverlakeaxis.com/investor-relations/investor-and-stock-information/analyst-reports.html

And its' competitors under page 2 of OSK DMG Q1 2015 Analyst Report.

My analysis might sometimes differ from the rest, but what I have written are important factors for me to determine if a stock is a value buy for the long term.

Lastly, I wish you success in investing! 🙂 Never give up whatever life throws at you!

Cheers,

EoTS

Hi EoTS

Silverlake drops to 0.880 today and still sliding…

question is why? do I buy more or hold? anyone knows what is causing this consistent drop ?

thanks

cheers

Today it drops to 0.875. Could not find relevant news causing this drop, any idea what could have been the cause? thanks

So, what's the story now… with all the careful analysis… nothing is going to change the continuous fall as seen in the current market. The painting was beautiful… and well engineered.

Attacked by shortseller report. Hopefully management can come up with something to support the price and destroy the shortists…

Hope so. But meanwhile i ll continue to hold the shares.

Sorry for this late reply.

By the time I wrote this, we all know it's the short seller report.

But I still decided to hold the shares as I feel that it has a strong moat and the fundamentals hasn't changed except the latest earnings wasn't good.

I m waiting for the report by Deloitte; though I don't expect it to be anytime soon.

Honestly, I didnt really have time to read the 42 pages report; barely skimmed through.

e.g section 8 of the report mentioned that

"Customers we spoke to believe the product is poorly designed with no version control which makes any update to the system exceedingly time-intensive and costly. These issues are making new customer wins very difficult, which calls into question the growth story peddled by management."

and the source which they quoted from are:

Senior IT Manager at Silverlake

ex-customer of Silverlake core banking software

Manager of Silverlake competitor

ex-Silverlake employee

I personally feel that these aren't credible sources and there's no way to prove it; and most importantly it is constructed such that it cant be falsified in any way; therefore, shouldn't be seriously considered w/o any significant evidence.

Never assume it must be right simply because it can’t be proven wrong…

Just my personal opinion, anyway…

What were your actions taken after the publishing of Deloitte's report? Care to elaborate your findings of the report?

Hi Anonymous,

Sorry for the late reply.

Yup i have just updated my blog that I've sold it earlier this year at $0.550. I will write a post on my thoughts of SLA.

In fact I am currently working on it now.

Hi Amonymous,

Sorry, it's been almost a year.

Yup, the main concern is the Related party transactions, where Goh have been selling companies through SSSB to SLA in exchange for shares and causing dilution in the outstanding shares.

I only managed to sit down and read the full report this year and so will update on my thoughts soon.

I know the market has reacted to the report much earlier and I could have blogged on this issue last year; but too caught up with work.

Have been quite stressful recently too. Hope thing gets better…sigh

You don't have to destroy the shorts but their thesis. Instead of wondering what's going on check the facts and the inter-party transactions highlighted by the shorts. If you are a risk averse long term value investor this stock is only for you if you come up with a conservative valuation significantly in excess of today's share price.